REVEALED: The German cities where property prices are soaring

Property portal Immoscout24 is forecasting rising house prices in five of Germany's major cities, with prices in Berlin expected to outpace other areas.

According to Immoscout24's latest research, the capital Berlin could see both new-build and existing property prices soar by 13 percent over the next 12 months.

On a national level, the cost of buying an existing property is set to rise by 11.3 percent, while new-build developments could rise by around nine percent. This is due to consistently high demand for property in Germany, researchers revealed.

In contrast, two of Germany's other major cities - Frankfurt and Munich - have much more modest growth forecasts. In Frankfurt, prices are expected to rise by around five percent for both new and existing apartments over the next twelve months, while in Munich newly built apartments could see an increase of only 2.5 percent, while the price of existing properties is expected to rise by six percent.

The stagnating growth in the property market is likely down to the fact that prices are already high in these areas, the property experts said.

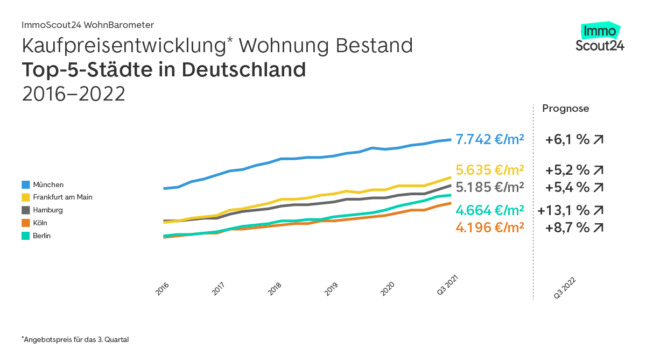

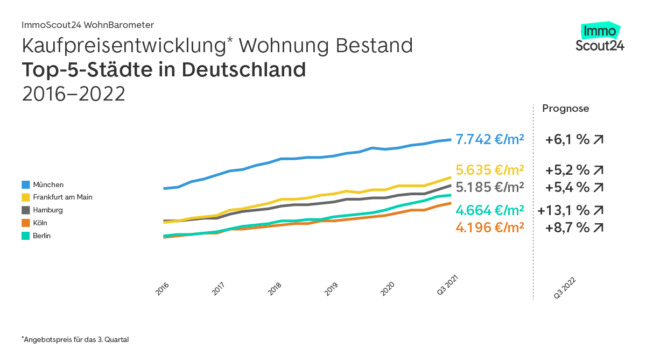

According to Immoscout24, an apartment in Frankfurt cost an average of €5,635 per square metre in the third quarter of 2021 - a figure only exceeded by the prices in Munich, which came in at €7,742 per square metre. In Berlin, on the other hand, buyers were expected to shell out €4,664 per square metre for an apartment. In Cologne, the cheapest of the five, the average apartment costs €4,196 per square metre.

That means that for an average 80 square metre flat in Frankfurt, you'll likely be looking at an asking price of around €450,000, compared to €373,120 for the same size property in Berlin.

Other experts have also forecasted slower growth in expensive cities like Frankfurt. Last week, Swiss bank UBS claimed that the Hessian city's real estate market had the highest risk of a price bubble of all the cities examined worldwide.

This is partly due to to recent dramatic increases in real estate prices. While rents in Frankfurt have increased by around three percent each year since 2016, property prices have jumped by 10 percent annually over the past five years. Meanwhile, the influx of new residents in the banking city came to a standstill in 2020.

With demand still high and interest rates low, real estate experts don't expect a downturn in prices anytime soon - but they also don't expect the rapid increase in prices to continue indefinitely.

READ ALSO: Why Frankfurt could have the biggest housing bubble in the world

Property prices up 63 percent since 2016

Within five years, the asking prices for new-built flats has gone up by 59 percent across the country, while the price of existing properties has risen by 63 percent - though the steep increases are showing signs of tapering off slightly.

In Immoscout24's survey of property listings on its search portal, the nationwide average asking price was 4.2 percent higher than in second quarter of the year. The average price per square meter was €2,513, which equates to an asking price of €201,000 on an 80-square-metre apartment.

In the previous quarter, prices increased by 4.4 percent, suggesting that the rapid growth is slowly somewhat. Nevertheless, buyers in the third quarter of 2021 still have to stump up €77,354 more for an 80-square-metre apartment than they did in late 2016.

The chat below shows the rise in property prices in the five major German cities between 2016 and 2021.

Photo: ImmoScout24

READ ALSO:

- EXPLAINED: The hidden costs of buying a house in Germany

- Why rent prices in major German cities are starting to fall

Meanwhile, the prices for newly built apartments rose even more in the third quarter than the prices for existing apartments. This type of property is now 4.7 percent more expensive than it was in the second quarter, which experts believe is due to higher construction and completion costs.

"The high demand for properties to buy and the increased costs in the construction industry continues to drive prices up," said Dr Thomas Schroeter, Managing Director of ImmoScout24.

"The price trend for new flats for sale is currently above the inflation rate, especially in Hamburg, Berlin and Cologne. By contrast, the ImmoScout24 WohnBarometer shows lower price increases for existing flats and new build houses in most other metropolitan areas."

Comments

See Also

According to Immoscout24's latest research, the capital Berlin could see both new-build and existing property prices soar by 13 percent over the next 12 months.

On a national level, the cost of buying an existing property is set to rise by 11.3 percent, while new-build developments could rise by around nine percent. This is due to consistently high demand for property in Germany, researchers revealed.

In contrast, two of Germany's other major cities - Frankfurt and Munich - have much more modest growth forecasts. In Frankfurt, prices are expected to rise by around five percent for both new and existing apartments over the next twelve months, while in Munich newly built apartments could see an increase of only 2.5 percent, while the price of existing properties is expected to rise by six percent.

The stagnating growth in the property market is likely down to the fact that prices are already high in these areas, the property experts said.

According to Immoscout24, an apartment in Frankfurt cost an average of €5,635 per square metre in the third quarter of 2021 - a figure only exceeded by the prices in Munich, which came in at €7,742 per square metre. In Berlin, on the other hand, buyers were expected to shell out €4,664 per square metre for an apartment. In Cologne, the cheapest of the five, the average apartment costs €4,196 per square metre.

That means that for an average 80 square metre flat in Frankfurt, you'll likely be looking at an asking price of around €450,000, compared to €373,120 for the same size property in Berlin.

Other experts have also forecasted slower growth in expensive cities like Frankfurt. Last week, Swiss bank UBS claimed that the Hessian city's real estate market had the highest risk of a price bubble of all the cities examined worldwide.

This is partly due to to recent dramatic increases in real estate prices. While rents in Frankfurt have increased by around three percent each year since 2016, property prices have jumped by 10 percent annually over the past five years. Meanwhile, the influx of new residents in the banking city came to a standstill in 2020.

With demand still high and interest rates low, real estate experts don't expect a downturn in prices anytime soon - but they also don't expect the rapid increase in prices to continue indefinitely.

READ ALSO: Why Frankfurt could have the biggest housing bubble in the world

Property prices up 63 percent since 2016

Within five years, the asking prices for new-built flats has gone up by 59 percent across the country, while the price of existing properties has risen by 63 percent - though the steep increases are showing signs of tapering off slightly.

In Immoscout24's survey of property listings on its search portal, the nationwide average asking price was 4.2 percent higher than in second quarter of the year. The average price per square meter was €2,513, which equates to an asking price of €201,000 on an 80-square-metre apartment.

In the previous quarter, prices increased by 4.4 percent, suggesting that the rapid growth is slowly somewhat. Nevertheless, buyers in the third quarter of 2021 still have to stump up €77,354 more for an 80-square-metre apartment than they did in late 2016.

The chat below shows the rise in property prices in the five major German cities between 2016 and 2021.

Photo: ImmoScout24

READ ALSO:

- EXPLAINED: The hidden costs of buying a house in Germany

- Why rent prices in major German cities are starting to fall

Meanwhile, the prices for newly built apartments rose even more in the third quarter than the prices for existing apartments. This type of property is now 4.7 percent more expensive than it was in the second quarter, which experts believe is due to higher construction and completion costs.

"The high demand for properties to buy and the increased costs in the construction industry continues to drive prices up," said Dr Thomas Schroeter, Managing Director of ImmoScout24.

"The price trend for new flats for sale is currently above the inflation rate, especially in Hamburg, Berlin and Cologne. By contrast, the ImmoScout24 WohnBarometer shows lower price increases for existing flats and new build houses in most other metropolitan areas."

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.