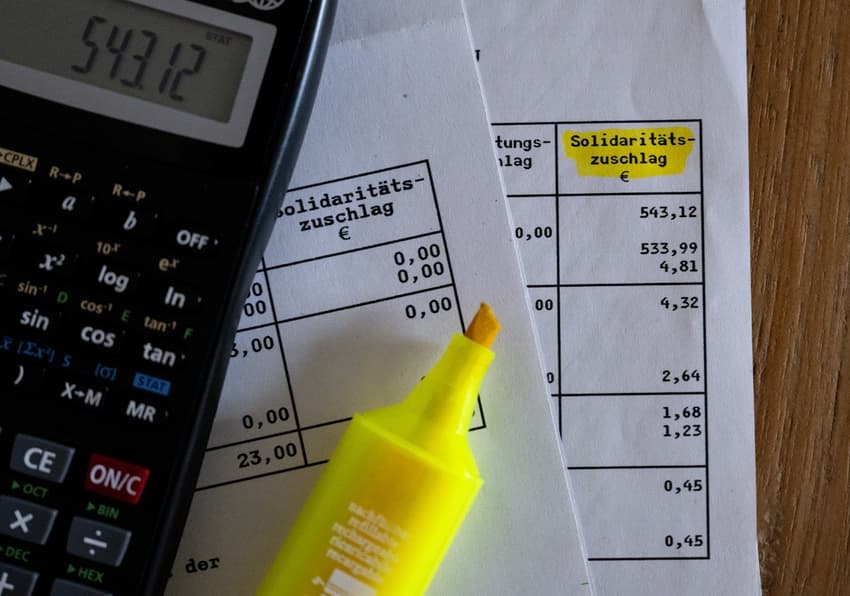

EXPLAINED: What German tax class are you in?

You're likely to run into Germany six different tax classes when you start paying taxes - or even whenever you use an online calculator to figure out how much the government is going to get from your salary. Here's what they all mean.

Germany's six different tax classes correspond to certain life situations. The most important determinant of what class you're in tends to be your marital status - followed by whether or not you have children.

You can move between different tax classes as your life situation changes - but you will only ever be in one at a time - with one notable exception.

Tax Class I

This one is pretty common. It applies to you if you're single, divorced, or widowed. It also applies to you if your married spouse lives abroad and isn't a legal resident of Germany.

Basically, if you're single and have no kids, you're probably in this tax class - particularly if you have a steady job where you earn at least €450 a month and don't earn any income from self-employment.

In this tax class, you obviously won't be eligible for tax benefits single parents can get - for example. Anything you earn over €450 a month is simply taxed normally.

READ ALSO: How much money could taxpayers in Germany save in 2024?

Tax Class II

You can get yourself added to this tax class if you make more than €450 a month and you're a single parent living in the same home as your child.

If that applies to you, you're eligible for certain tax relief measures from being in this tax class.

That said, you will need to apply to join this tax class. It won't happen automatically.

A worker does their German tax return at home. Photo: picture alliance/dpa/BCD Travel | BCD Travel Germany GmbH

Tax Class III and Tax Class V

If you're married and your spouse lives with you in Germany and there's a big difference in your earnings, one of you can be in this tax class and one of you can be in Tax Class V. You must, however, apply to join these tax classes. Otherwise a married couple will be placed in Tax Class IV by default.

Assigning the couple to two different tax classes is Germany's way of facilitating income splitting. The partner in Tax Class III sees their tax-free allowance double, and has the lowest possible rate of taxation.

Meanwhile, to offset this, the partner in Tax Class V has almost no tax-free allowance - but enjoys one of the largest plethora of possible deductions.

The Tax Class III/V split tends to happen if one partner is earning at least 60 percent of the couple's annual total income. The partner who makes more is in Tax Class III whereas the one who makes less will be in Tax Class V.

READ ALSO: Should you get a tax advisor in Germany - and how much does it cost?

Tax Class IV

Married couples who don't apply to be in a Tax Class III/V split will automatically be assigned here. If you don't have as bit of a disparity in your incomes, Tax Class IV likely makes the most sense.

Although the lower-earning partner's tax burden is still higher than they might expect if they were single, the tax office evens this out by exempting them from certain additional payments.

Tax Class VI

This tax class if for someone who works more than one job that's subject to tax and social security contributions.

What's important to note here is that only one of your jobs is in Tax Class VI, while the other is in another tax class. This is the only case where someone working in Germany is in more than one tax class.

Typically, your main job would be subject to your regular tax class and any extra ones you do would be in Tax Class VI. So, for example, someone who works four days a week in one position at one workplace and then one day a week at another might see the revenue from their one-day a week job classified into Tax Class VI.

Tax Class VI doesn't apply to a freelancer who has many clients - as they're self-employed and pay tax and social security on the aggregate income they take in for themselves. However, someone who works three days a week at a company and then freelances the other two days could place their freelance income into Tax Class VI.

READ ALSO: I just got married in Germany. How does this affect my taxes?

Comments

See Also

Germany's six different tax classes correspond to certain life situations. The most important determinant of what class you're in tends to be your marital status - followed by whether or not you have children.

You can move between different tax classes as your life situation changes - but you will only ever be in one at a time - with one notable exception.

Tax Class I

This one is pretty common. It applies to you if you're single, divorced, or widowed. It also applies to you if your married spouse lives abroad and isn't a legal resident of Germany.

Basically, if you're single and have no kids, you're probably in this tax class - particularly if you have a steady job where you earn at least €450 a month and don't earn any income from self-employment.

In this tax class, you obviously won't be eligible for tax benefits single parents can get - for example. Anything you earn over €450 a month is simply taxed normally.

READ ALSO: How much money could taxpayers in Germany save in 2024?

Tax Class II

You can get yourself added to this tax class if you make more than €450 a month and you're a single parent living in the same home as your child.

If that applies to you, you're eligible for certain tax relief measures from being in this tax class.

That said, you will need to apply to join this tax class. It won't happen automatically.

Tax Class III and Tax Class V

If you're married and your spouse lives with you in Germany and there's a big difference in your earnings, one of you can be in this tax class and one of you can be in Tax Class V. You must, however, apply to join these tax classes. Otherwise a married couple will be placed in Tax Class IV by default.

Assigning the couple to two different tax classes is Germany's way of facilitating income splitting. The partner in Tax Class III sees their tax-free allowance double, and has the lowest possible rate of taxation.

Meanwhile, to offset this, the partner in Tax Class V has almost no tax-free allowance - but enjoys one of the largest plethora of possible deductions.

The Tax Class III/V split tends to happen if one partner is earning at least 60 percent of the couple's annual total income. The partner who makes more is in Tax Class III whereas the one who makes less will be in Tax Class V.

READ ALSO: Should you get a tax advisor in Germany - and how much does it cost?

Tax Class IV

Married couples who don't apply to be in a Tax Class III/V split will automatically be assigned here. If you don't have as bit of a disparity in your incomes, Tax Class IV likely makes the most sense.

Although the lower-earning partner's tax burden is still higher than they might expect if they were single, the tax office evens this out by exempting them from certain additional payments.

Tax Class VI

This tax class if for someone who works more than one job that's subject to tax and social security contributions.

What's important to note here is that only one of your jobs is in Tax Class VI, while the other is in another tax class. This is the only case where someone working in Germany is in more than one tax class.

Typically, your main job would be subject to your regular tax class and any extra ones you do would be in Tax Class VI. So, for example, someone who works four days a week in one position at one workplace and then one day a week at another might see the revenue from their one-day a week job classified into Tax Class VI.

Tax Class VI doesn't apply to a freelancer who has many clients - as they're self-employed and pay tax and social security on the aggregate income they take in for themselves. However, someone who works three days a week at a company and then freelances the other two days could place their freelance income into Tax Class VI.

READ ALSO: I just got married in Germany. How does this affect my taxes?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.