Why more and more Americans in Europe are renouncing their US citizenship

Thousands of American citizens in Europe and their 'Accidental’ American compatriots pay steep costs to give up their US passports each year. Helen Burggraf explains why the numbers have been growing.

More than 30,000 Americans have given up their US citizenship over the past decade, according to the list of names published by the US government.

The number of Americans renouncing has been running at between 1,000 right up to 6,000 a year since 2010.

But the figures weren't always so high before 2010.

This is because that year saw the signing into law of a major new regulation known as the Foreign Account Tax Compliance Act (FATCA).

It went almost unnoticed at the time, because it appeared to be nothing more than a revenue-providing element of a domestic jobs bill known as the HIRE Act. Its main purpose was to put an end to the use of non-US bank accounts by wealthy, US-based residents who sought to hide their money from the US tax authorities.

READ ALSO: How Americans in Europe are struggling to renounce their US citizenship

FATCA basically mandates stiff penalties for “foreign financial institutions” (FFIs) that fail to report to the US authorities the bank account details, including assets, of any of their clients who happen to be US citizens or Green Card holders.

But its unintended (and massive) side effect was to cause many non-US financial institutions around the world to suddenly refuse to accept American clients at all – even if they were living in the country in which these institutions were (and are) located, and had held accounts with these institutions for decades.

“FATCA effectively turned all of the world’s non-US banks and financial institutions into agents of the US Internal Revenue Service,” said one Paris-based American, who says he has no plans to give up his passport, despite recently having been told to move his bank account elsewhere.

The reason FATCA is such a game-changer

American campaigners for a fairer system for US expatriates note that by itself, FATCA isn’t the problem: it’s the combination of this law and the fact that the United States taxes on the basis of citizenship rather than individuals’ places of residence – one of the only countries on the planet to do so, apart from Eritrea. (Foreigners who live in the US are also taxed, in spite of not being US citizens, however.)

This “citizenship-based taxation” quirk dates back to the time of the US Civil War (1861-1865), and yet Washington lawmakers have never managed to agree on replacing it with a residence-based regime, even though calls for them to do so, mainly from expats, get louder every year.

This means that Americans living abroad must file a US tax return every year that they’re abroad, even if this ends up being 60 or more years, and even if, as is usually the case, the amount they pay to the tax authority in the country where they’re living is enough that they don’t owe Uncle Sam anything.

Especially for those whose financial lives are anything but simple, expat American campaigners point out, the argument for hiring a knowledgeable tax professional to help with one’s US tax returns is compelling, in order to ensure they don’t incur the persecutory penalties that even easily-made tax-return mistakes can result in.

So although American expats tended initially to focus on FATCA as the source of their problems, and urged US lawmakers to abolish it, their advocacy efforts are now almost entirely centred on replacing citizenship based taxation (CBT) with a residence-based tax system (RBT), like the rest of the world has.

Some campaigners, though, continue to push back against FATCA for its abuse of data protection regulations in the countries in which they live -- including Europe -- while lawmakers in some countries, as well as in the European Parliament, have raised the issue of what they say is FATCA’s “lack of reciprocity” when it comes to providing them with the US banking data of their taxpayers.

“CBT is incompatible with the global economy of the 21st century, where the tax policy of most industrialised nations is based on residency,” one of the main advocacy groups, the Washington-based American Citizens Abroad (ACA), explains on its website.

“CBT works against US economic interests [and is] not the worldwide norm.”

Doris Speer, president of the Paris-based Association of Americans Resident Overseas said: "We believe that the key concerns of Americans who choose to live abroad can be best addressed by severing citizenship from tax residency."

AARO, ACA and other groups argue that if this were done, it would put an end to most of the US citizenship renunciations now taking place, in addition to making life better for the millions of American expats who have no desire to renounce, but who nevertheless struggle with the myriad tax and financial difficulties that for most, simply didn’t exist before 2010.

Tax-related difficulties

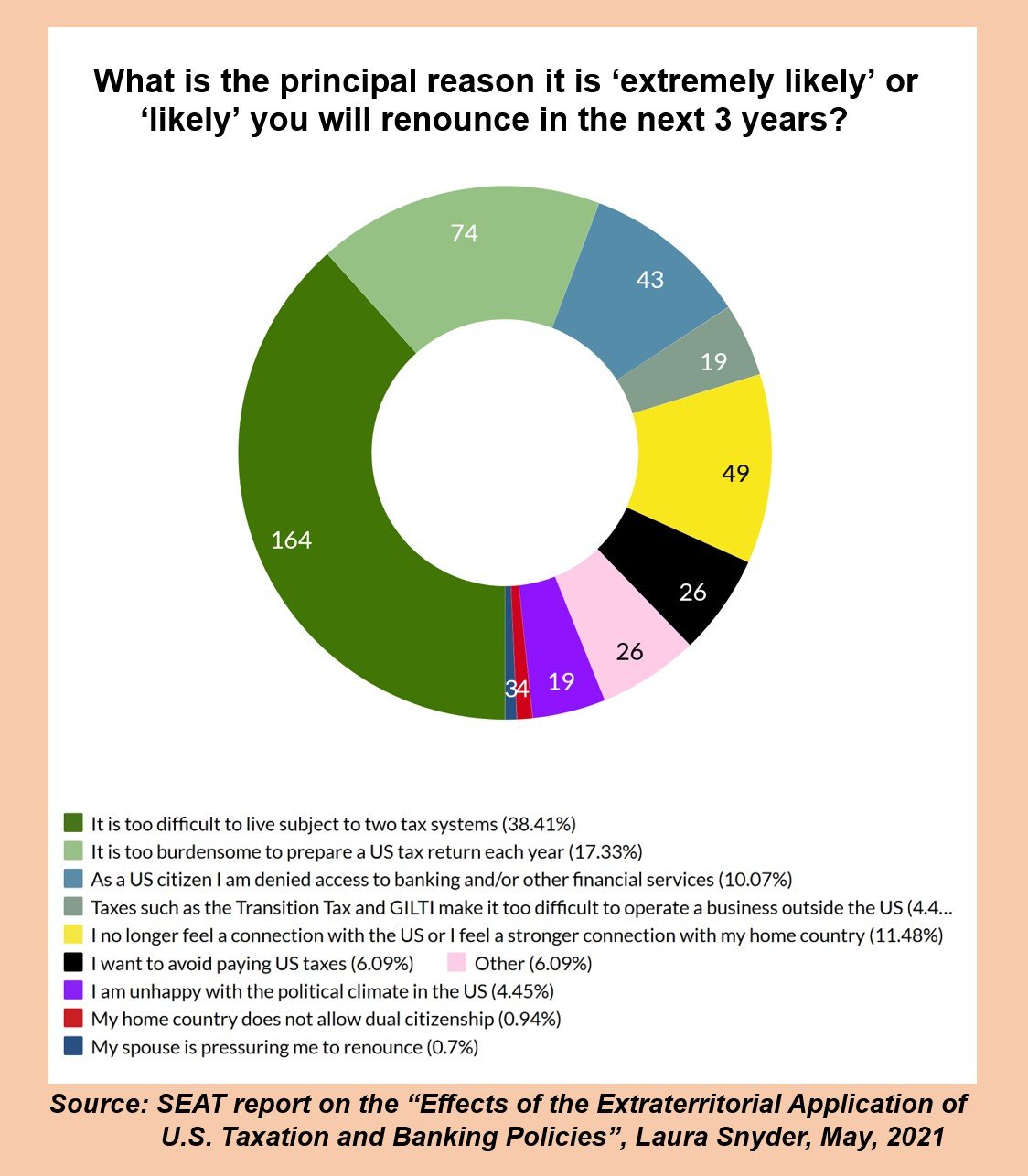

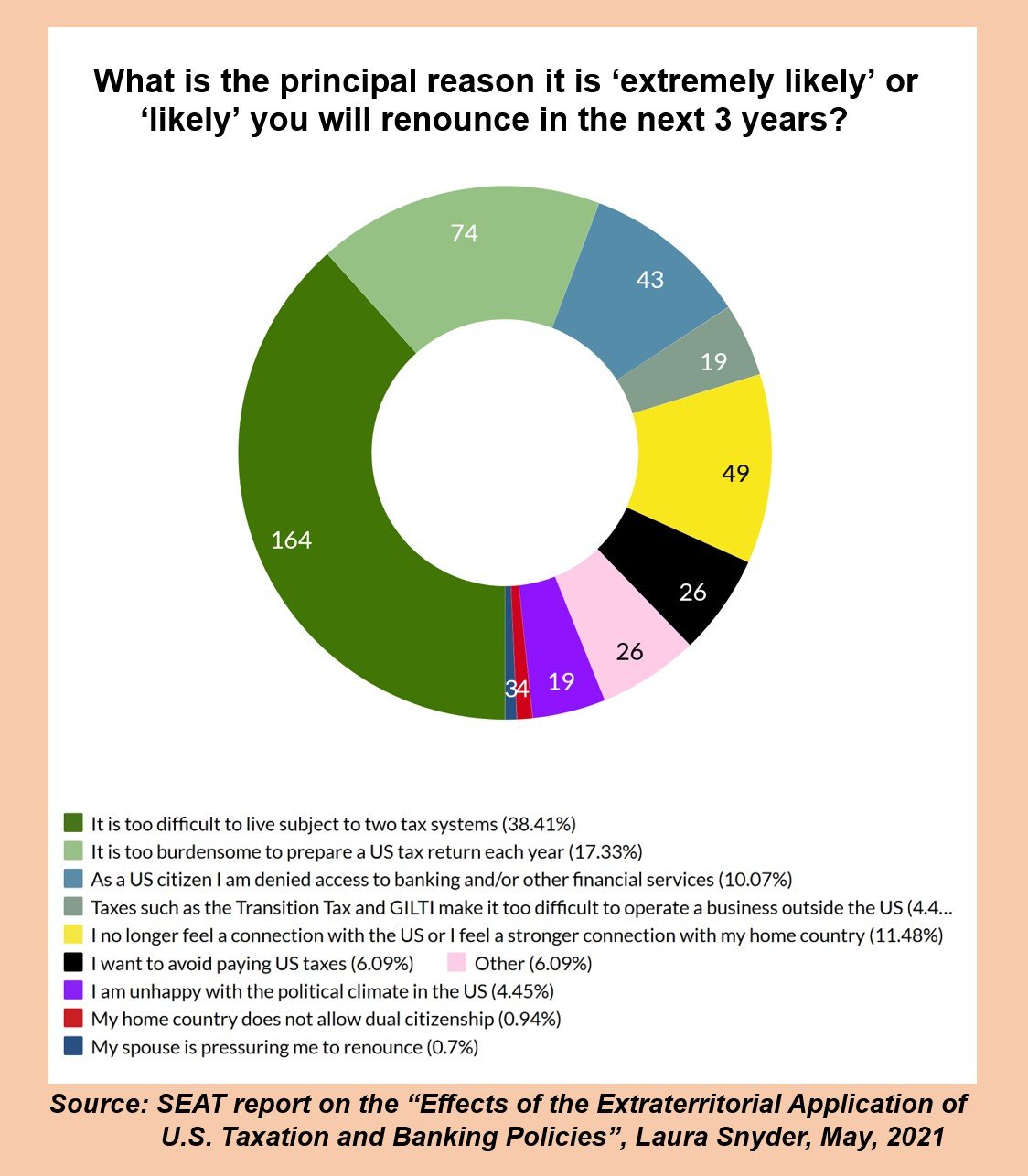

The degree to which US nationals living in Europe are struggling with these difficulties was highlighted two years ago, when a Paris-based expatriate advocacy organisation called Stop Extraterritorial American Taxation (SEAT) published the results of a comprehensive global survey of some 1,564 American and formerly-American expats that it had done in the final few months of 2020.

More than half (55.74%) of those respondents who said they were either “likely” or “extremely likely” to renounce their US citizenships within the next three years, for example, cited the difficulties involved in complying with their US tax obligations as their “principal reason” for doing so.

The SEAT survey was overseen by SEAT president and co-founder Laura Snyder, and may be viewed and downloaded by clicking here.

A special case: the ‘accidental American’

One category of US citizen living abroad that deserves a special mention is that of what are typically referred to as “accidental Americans.”

Such “accidentals” are citizens of a country other than the United States, but are nevertheless considered by the US to be Americans, usually because they were born in the US, often to non-American parents, who soon returned to the country they were from.

This means that they are subject to all of the costs and hassles that “regular” American expats struggle with, even though they are, basically, not American in any way beyond their citizenship. They have few if any ties to the country and are often unable to speak English, and having never lived and worked there.

One such “accidental” is Fabien Lehagre, who was born in California but came to France with his French father at the age of 18 months.

Lehagre founded the Paris-based Association of Accidental Americans (AAA), in 2017 and has been campaigning for fairer treatment for Accidental Americans ever since, which includes making it easier and far less costly for them to renounce US citizenship.

It currently costs $2,350 for Americans to give up their citizenship but the US government has finally made moves to cut the fee to $450, which many believe is still too costly.

READ ALSO: Americans in Europe who renounced citizenship sue over 'capricious' fee

This reduction, once it eventually goes through, may push up the numbers of Americans in Europe renouncing citizenship even further, although some believe it will have little impact.

"For those Americans living abroad who are seeking to renounce, the advantages [of no longer being American] are worth far more than $2,350,” says Toronto-based lawyer and US expatriation expert John Richardson.

Have you already or are you in the process of renouncing US citizenship, please email us at [email protected]. We'd love to hear from you.

Comments

See Also

More than 30,000 Americans have given up their US citizenship over the past decade, according to the list of names published by the US government.

The number of Americans renouncing has been running at between 1,000 right up to 6,000 a year since 2010.

But the figures weren't always so high before 2010.

This is because that year saw the signing into law of a major new regulation known as the Foreign Account Tax Compliance Act (FATCA).

It went almost unnoticed at the time, because it appeared to be nothing more than a revenue-providing element of a domestic jobs bill known as the HIRE Act. Its main purpose was to put an end to the use of non-US bank accounts by wealthy, US-based residents who sought to hide their money from the US tax authorities.

READ ALSO: How Americans in Europe are struggling to renounce their US citizenship

FATCA basically mandates stiff penalties for “foreign financial institutions” (FFIs) that fail to report to the US authorities the bank account details, including assets, of any of their clients who happen to be US citizens or Green Card holders.

But its unintended (and massive) side effect was to cause many non-US financial institutions around the world to suddenly refuse to accept American clients at all – even if they were living in the country in which these institutions were (and are) located, and had held accounts with these institutions for decades.

“FATCA effectively turned all of the world’s non-US banks and financial institutions into agents of the US Internal Revenue Service,” said one Paris-based American, who says he has no plans to give up his passport, despite recently having been told to move his bank account elsewhere.

The reason FATCA is such a game-changer

American campaigners for a fairer system for US expatriates note that by itself, FATCA isn’t the problem: it’s the combination of this law and the fact that the United States taxes on the basis of citizenship rather than individuals’ places of residence – one of the only countries on the planet to do so, apart from Eritrea. (Foreigners who live in the US are also taxed, in spite of not being US citizens, however.)

This “citizenship-based taxation” quirk dates back to the time of the US Civil War (1861-1865), and yet Washington lawmakers have never managed to agree on replacing it with a residence-based regime, even though calls for them to do so, mainly from expats, get louder every year.

This means that Americans living abroad must file a US tax return every year that they’re abroad, even if this ends up being 60 or more years, and even if, as is usually the case, the amount they pay to the tax authority in the country where they’re living is enough that they don’t owe Uncle Sam anything.

Especially for those whose financial lives are anything but simple, expat American campaigners point out, the argument for hiring a knowledgeable tax professional to help with one’s US tax returns is compelling, in order to ensure they don’t incur the persecutory penalties that even easily-made tax-return mistakes can result in.

So although American expats tended initially to focus on FATCA as the source of their problems, and urged US lawmakers to abolish it, their advocacy efforts are now almost entirely centred on replacing citizenship based taxation (CBT) with a residence-based tax system (RBT), like the rest of the world has.

Some campaigners, though, continue to push back against FATCA for its abuse of data protection regulations in the countries in which they live -- including Europe -- while lawmakers in some countries, as well as in the European Parliament, have raised the issue of what they say is FATCA’s “lack of reciprocity” when it comes to providing them with the US banking data of their taxpayers.

“CBT is incompatible with the global economy of the 21st century, where the tax policy of most industrialised nations is based on residency,” one of the main advocacy groups, the Washington-based American Citizens Abroad (ACA), explains on its website.

“CBT works against US economic interests [and is] not the worldwide norm.”

Doris Speer, president of the Paris-based Association of Americans Resident Overseas said: "We believe that the key concerns of Americans who choose to live abroad can be best addressed by severing citizenship from tax residency."

AARO, ACA and other groups argue that if this were done, it would put an end to most of the US citizenship renunciations now taking place, in addition to making life better for the millions of American expats who have no desire to renounce, but who nevertheless struggle with the myriad tax and financial difficulties that for most, simply didn’t exist before 2010.

Tax-related difficulties

The degree to which US nationals living in Europe are struggling with these difficulties was highlighted two years ago, when a Paris-based expatriate advocacy organisation called Stop Extraterritorial American Taxation (SEAT) published the results of a comprehensive global survey of some 1,564 American and formerly-American expats that it had done in the final few months of 2020.

More than half (55.74%) of those respondents who said they were either “likely” or “extremely likely” to renounce their US citizenships within the next three years, for example, cited the difficulties involved in complying with their US tax obligations as their “principal reason” for doing so.

The SEAT survey was overseen by SEAT president and co-founder Laura Snyder, and may be viewed and downloaded by clicking here.

A special case: the ‘accidental American’

One category of US citizen living abroad that deserves a special mention is that of what are typically referred to as “accidental Americans.”

Such “accidentals” are citizens of a country other than the United States, but are nevertheless considered by the US to be Americans, usually because they were born in the US, often to non-American parents, who soon returned to the country they were from.

This means that they are subject to all of the costs and hassles that “regular” American expats struggle with, even though they are, basically, not American in any way beyond their citizenship. They have few if any ties to the country and are often unable to speak English, and having never lived and worked there.

One such “accidental” is Fabien Lehagre, who was born in California but came to France with his French father at the age of 18 months.

Lehagre founded the Paris-based Association of Accidental Americans (AAA), in 2017 and has been campaigning for fairer treatment for Accidental Americans ever since, which includes making it easier and far less costly for them to renounce US citizenship.

It currently costs $2,350 for Americans to give up their citizenship but the US government has finally made moves to cut the fee to $450, which many believe is still too costly.

READ ALSO: Americans in Europe who renounced citizenship sue over 'capricious' fee

This reduction, once it eventually goes through, may push up the numbers of Americans in Europe renouncing citizenship even further, although some believe it will have little impact.

"For those Americans living abroad who are seeking to renounce, the advantages [of no longer being American] are worth far more than $2,350,” says Toronto-based lawyer and US expatriation expert John Richardson.

Have you already or are you in the process of renouncing US citizenship, please email us at [email protected]. We'd love to hear from you.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.