MAP: Where property prices are forecast to rise and fall in Germany

A new study suggests that all is not as gloomy on the German property market as it seems - though some regions will fare much better than others over the next twelve years.

Over the past year or so, Germany's housing market has been struggling against some strong headwinds. Soaring interest rates, cautious lenders and sky-high inflation have turned buyers back towards the rental market - and many have speculated that the boom years have come to an end.

More recently, however, there have been whispers of a turnaround in fortunes. Despite yet another hike in interest rates from the European Central Bank (ECB), German property prices stagnated in second quarter of 2023 rather than falling.

Sales prices for flats only fell by an average of 0.3 percent from April to June compared to the previous quarter, according to the Greix real estate price index published by the Kiel Institute for the World Economy (IfW).

Prices for detached and semi-detached homes, meanwhile, shot up by 2.3 percent and 1.8 percent respectively.

"The German real estate market showed itself to be quite robust in the second quarter," said IfW President Moritz Schularick.

"The expectation that the ECB's interest rate hikes are gradually coming to an end has quite obviously done the real estate market good after the significant price corrections of recent months."

A new study from EY has also predicted a rosier-than-expected outlook for construction companies, with the sector likely to bounce back from months of turmoil in 2024.

READ ALSO: REVEALED: How the cost of renting in Germany compares to home ownership

The sector has had to contend with the rising cost of building materials, supply bottle necks and expensive credit, all of which have made new construction projects increasingly unviable.

However, according to EY's analysis, the industry should find a new equilibrium as inflation falls and politicians intervene to meet their housebuilding targets. Meanwhile, construction prices, which have risen historically, should at least normalise, it said.

That means that, after contracting by 2.6 percent in 2023, construction volume should stagnate next year and even rise by 1.9 percent as early as 2025.

What will happen to property prices in the long-term?

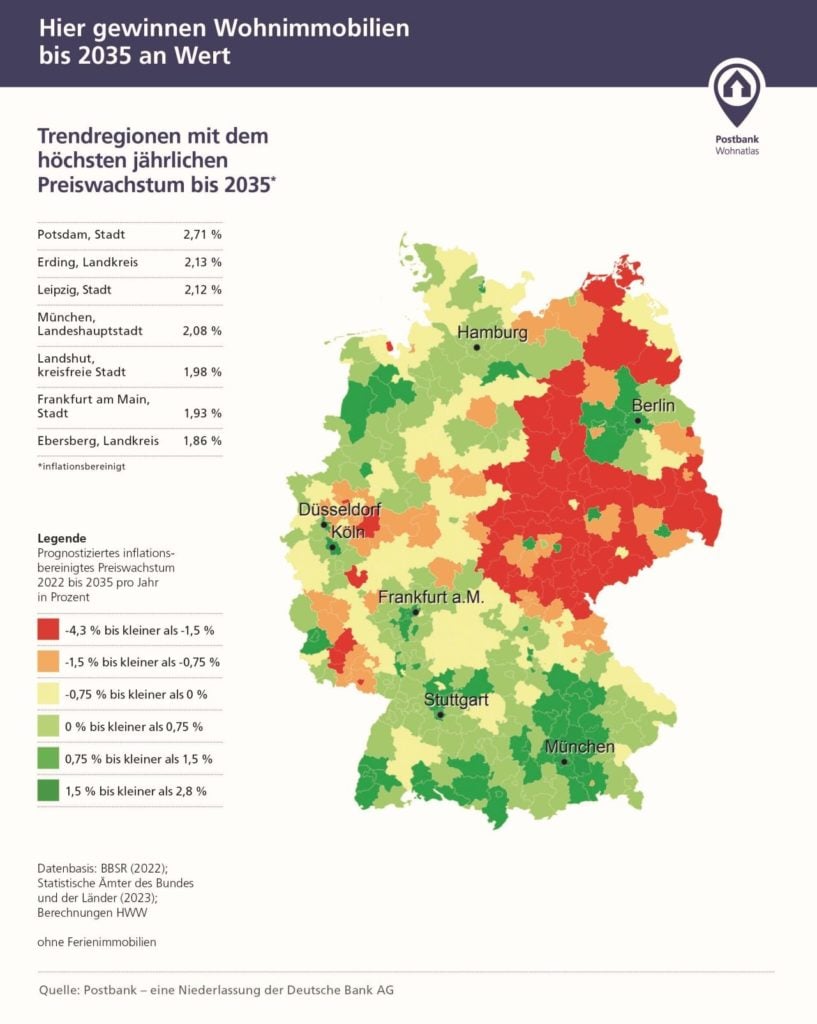

According to a recent study by Postbank and the Hamburg Institute of International Economics (HWWI), the German housing market is indeed likely to recover its health in the coming years - but only in sought-after regions.

In around half of the 400 districts and cities surveyed, prices are expected to fall by around two percent in real terms by 2035. In a further 43 percent of the districts, however, prices are set to rise.

The biggest winner in terms of rising real estate prices will be Potsdam, which is located in Brandenburg on the outskirts of Berlin. Prices of property in the small city could rise by as much as 2.71 percent per year by 2035, putting it at the top of the league table for growth.

In second place came Erding, on the outskirts of Munich, with growth of around 2.13 percent per year. Leipzig in Saxony also scored well with predicted growth of 2.12 percent per year, as did Frankfurt am Main with growth of 1.93 per year and Cologne with growth of 1.52 percent per year.

READ ALSO: Ask an expert: Is now a good time to buy property in Germany?

The map below shows the predicted development of property prices in Germany until 2035, with dark green representing growth of between 1.5 and 2.8 percent per year and red representing declines of between 1.5 and 4.3 percent per year.

Orange and yellow show decreases of between 0 and 1.5 percent, while lighter greens show increases of between 0 and 1.5 percent.

All of the remaining top 10 - including Landshut, Munich and Augsburg - were all located in Bavaria.

"The attractiveness of the metropolitan regions remains unbroken even after the corona pandemic," said Postbank's property project manager Manuel Beermann. "As the examples of Munich and Erding as well as Berlin and Potsdam show, the prices for condominiums in the surrounding areas will even rise more than in the metropolises themselves."

However, buyers in all of the so-called 'big seven' can be happy with their choice, since prices are set to rise in each of the major cities. At 0.29 percent per year, Hamburg will see the lowest growth, while well-heeled Munich will see the highest (2.08 percent).

With predicted growth of 1.24 percent per year, Berlin is also set to fare well in the coming years.

READ ALSO: REVEALED: The German regions where property prices are falling and rising the most

Where will prices go down?

According to HWWI's analysis, properties in regions with poor infrastructure and declining populations - particularly in the former eastern states - are set to drop in value over the next decade.

This applies to many regions in Saxony-Anhalt, Thuringia, Saxony, Mecklenburg-Western Pomerania and Saarland.

In the eastern German states, rural areas with poor links to the major cities and outside of the Berlin commuter belt are set to be worst-affected.

Here, prices could plummet at a rate of between 1.5 percent and 4.3 percent per year.

Comments

See Also

Over the past year or so, Germany's housing market has been struggling against some strong headwinds. Soaring interest rates, cautious lenders and sky-high inflation have turned buyers back towards the rental market - and many have speculated that the boom years have come to an end.

More recently, however, there have been whispers of a turnaround in fortunes. Despite yet another hike in interest rates from the European Central Bank (ECB), German property prices stagnated in second quarter of 2023 rather than falling.

Sales prices for flats only fell by an average of 0.3 percent from April to June compared to the previous quarter, according to the Greix real estate price index published by the Kiel Institute for the World Economy (IfW).

Prices for detached and semi-detached homes, meanwhile, shot up by 2.3 percent and 1.8 percent respectively.

"The German real estate market showed itself to be quite robust in the second quarter," said IfW President Moritz Schularick.

"The expectation that the ECB's interest rate hikes are gradually coming to an end has quite obviously done the real estate market good after the significant price corrections of recent months."

A new study from EY has also predicted a rosier-than-expected outlook for construction companies, with the sector likely to bounce back from months of turmoil in 2024.

READ ALSO: REVEALED: How the cost of renting in Germany compares to home ownership

The sector has had to contend with the rising cost of building materials, supply bottle necks and expensive credit, all of which have made new construction projects increasingly unviable.

However, according to EY's analysis, the industry should find a new equilibrium as inflation falls and politicians intervene to meet their housebuilding targets. Meanwhile, construction prices, which have risen historically, should at least normalise, it said.

That means that, after contracting by 2.6 percent in 2023, construction volume should stagnate next year and even rise by 1.9 percent as early as 2025.

What will happen to property prices in the long-term?

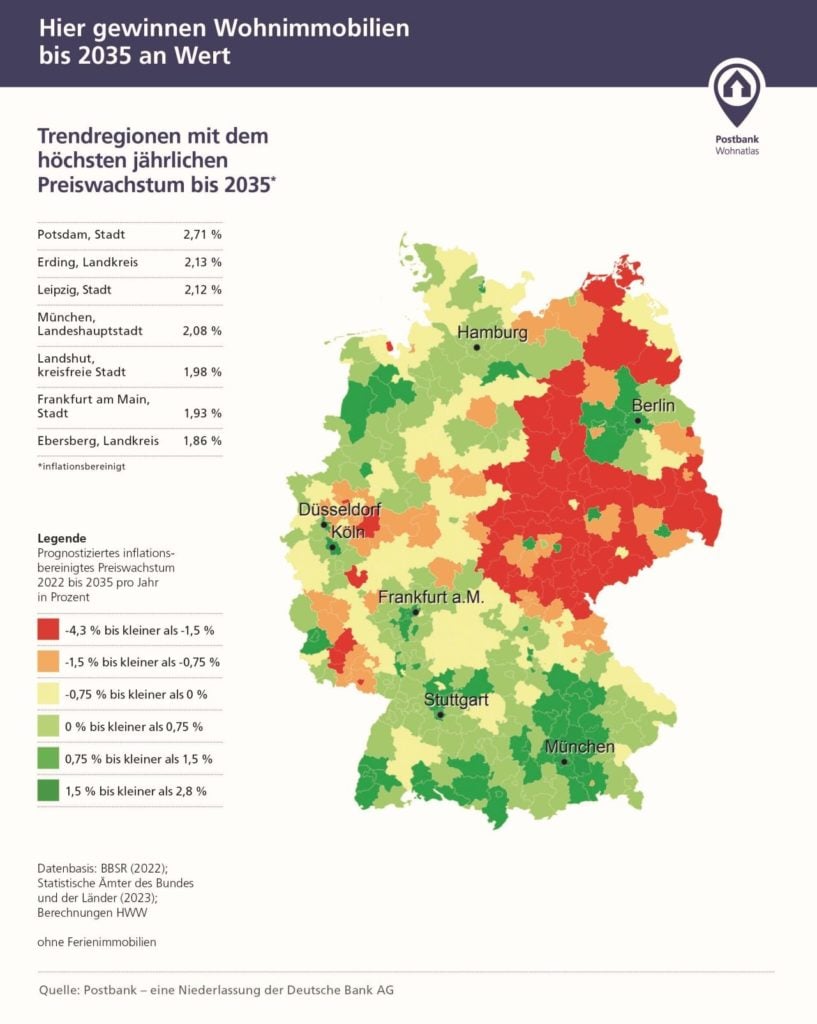

According to a recent study by Postbank and the Hamburg Institute of International Economics (HWWI), the German housing market is indeed likely to recover its health in the coming years - but only in sought-after regions.

In around half of the 400 districts and cities surveyed, prices are expected to fall by around two percent in real terms by 2035. In a further 43 percent of the districts, however, prices are set to rise.

The biggest winner in terms of rising real estate prices will be Potsdam, which is located in Brandenburg on the outskirts of Berlin. Prices of property in the small city could rise by as much as 2.71 percent per year by 2035, putting it at the top of the league table for growth.

In second place came Erding, on the outskirts of Munich, with growth of around 2.13 percent per year. Leipzig in Saxony also scored well with predicted growth of 2.12 percent per year, as did Frankfurt am Main with growth of 1.93 per year and Cologne with growth of 1.52 percent per year.

READ ALSO: Ask an expert: Is now a good time to buy property in Germany?

The map below shows the predicted development of property prices in Germany until 2035, with dark green representing growth of between 1.5 and 2.8 percent per year and red representing declines of between 1.5 and 4.3 percent per year.

Orange and yellow show decreases of between 0 and 1.5 percent, while lighter greens show increases of between 0 and 1.5 percent.

All of the remaining top 10 - including Landshut, Munich and Augsburg - were all located in Bavaria.

"The attractiveness of the metropolitan regions remains unbroken even after the corona pandemic," said Postbank's property project manager Manuel Beermann. "As the examples of Munich and Erding as well as Berlin and Potsdam show, the prices for condominiums in the surrounding areas will even rise more than in the metropolises themselves."

However, buyers in all of the so-called 'big seven' can be happy with their choice, since prices are set to rise in each of the major cities. At 0.29 percent per year, Hamburg will see the lowest growth, while well-heeled Munich will see the highest (2.08 percent).

With predicted growth of 1.24 percent per year, Berlin is also set to fare well in the coming years.

READ ALSO: REVEALED: The German regions where property prices are falling and rising the most

Where will prices go down?

According to HWWI's analysis, properties in regions with poor infrastructure and declining populations - particularly in the former eastern states - are set to drop in value over the next decade.

This applies to many regions in Saxony-Anhalt, Thuringia, Saxony, Mecklenburg-Western Pomerania and Saarland.

In the eastern German states, rural areas with poor links to the major cities and outside of the Berlin commuter belt are set to be worst-affected.

Here, prices could plummet at a rate of between 1.5 percent and 4.3 percent per year.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.