'Ridiculous': Foreigners in Germany hit by high fees on non-EU parcels

The Local's readers have been reporting unexpectedly steep duty fees on packages to Germany from outside the EU. Here's what they had to say.

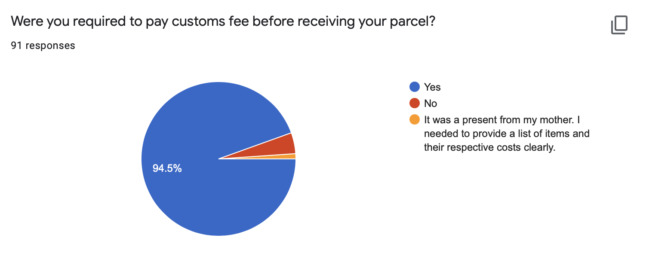

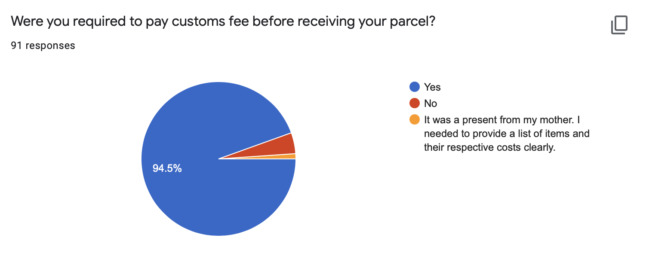

In a survey asking for your experiences, 94.5 percent of nearly 100 people who replied to us said they had to pay customs fees before receiving their parcel in Germany.

Source: The Local's Google form

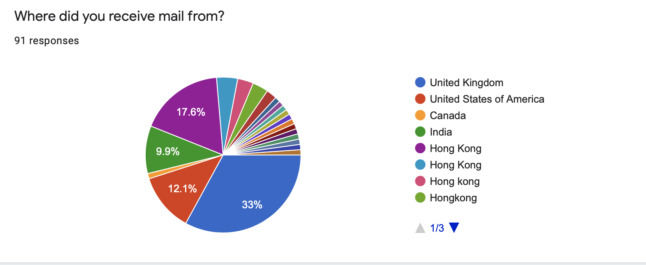

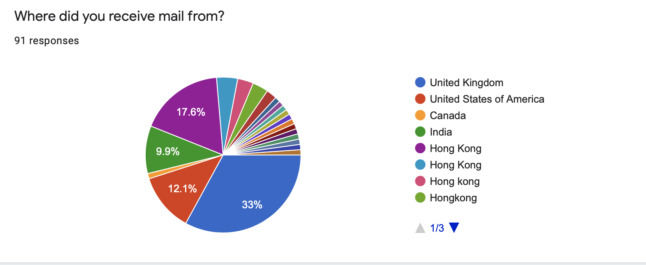

Around 33 percent of the responses came from people receiving packages from the UK to Germany. Other countries where packages with customs charges were mentioned frequently were Hong Kong, the USA and India.

Source: The Local's Google form

Most readers told us the fees were a surprise to them, and many said they felt they shouldn't have been charged.

Others raised questions over the administrative fee or Auslagepauschale (usually around €6).

'Ridiculous amount'

The EU’s taxation and customs union website says that private packages with a value of up to €45 “are not subject to prohibitions or restrictions,” and Germany’s customs and finance authority has also confirmed that gifts of up to €45 are not subject to customs duty or VAT charges.

Many readers said they shouldn't have had to pay any customs fees.

Rebecca, 24, in Stuttgart said she received a 4kg parcel from the UK valued at £21 and was charged €4.67 customs fees plus the €6 handling cost.

"This parcel was of old things I already owned, and was below the customs value so I shouldn't have had to pay anything, let alone pay half the value of the contents again in customs, it was a ridiculous amount," she said.

"I didn't understand why I was paying so much or what the difference between Zoll (customs duty) and Auslagepauschale (handling fee) was, but I knew if I tried to question it at the post office I wouldn't understand the explanation either, so I just paid the amount."

Martin, 37, Zwickau, was charged €8.26 in total (including the service fee) for a £10 gift sent from the UK.

"The CN22 (customs) form was declared as a £10 gift," he explained. "VAT should not have applied as it was below €45.

'Angry and hopeless'

People sending packages from non-EU countries have always had to deal with duty fees and customs declarations, but several readers from countries, including Hong Kong and the USA, told us they have recently been hit with unexpected charges..

This may be linked to a change regarding fees last year. Until June 30th, 2021, packages imported into the EU with a value of less than €22 were exempt from import VAT charges. That exemption was shelved on July 1st, meaning that VAT is now due on all goods imported into the bloc.

But, as we mentioned, that should not apply to private packages or gifts under €45.

Abbie, 34, in Dresden said she was charged a €2 custom fee by DHL, plus the €6 handling fee, to receive a gift from a friend in Hong Kong.

"It's robbery," she said. "I actually asked my friends and family not to send me anything anymore, although it's the only way they can show me physical love during the pandemic."

READ ALSO: Why people in Germany are being charged to receive small packages from outside the EU

A DHL worker carrying out deliveries. Photo: picture alliance/dpa | Sebastian Gollnow

Vivian, 54, in Biberach, south-west Germany, said she regularly receives post from Australia and Malaysia. She had to pay €9 in fees for a €29 gift.

Doris, 37, in Berlin, said she was charged €2.10 plus a €6 admin charge to pick up a parcel that weighed 1kg from Hong Kong.

"It was used clothes and a small gift from a friend for our newborn baby," she said. "It was written clearly on the parcel that it's gift. It is worth €10 only, but we were still charged a total of €8,10. We found it quite ridiculous."

Alyssa, 33, in Hamburg said she was charged a fee to receive a hand crocheted blanket by her grandma sent from the USA.

She said authorities "basically held it ransom for €50".

Claudia, 29, in Troisdorf said she felt "angry and hopeless" at having to pay high fees on packages from Hong Kong.

"I feel like there is no one who can help me in the situation, even though I have made a complaint," she said.

Yi, 34, said they had to pay around €14 to get a package containing "my books and some snacks from my home city" in Hong Kong

Meanwhile, a 40-year-old in Mainz, who described the system of customs fees and administrative charges in Germany as a "total disaster" said they suspected issues around discrimination and racism.

"I've heard that it would help if the name of the receiver is a German or English name - basically not Asia-oriented. I haven't tried as my husband and me are both from Hong Kong."

'I will never buy anything from UK'

For people receiving packages from the UK, this is a fairly new issue. Before Brexit, duty fees did not apply because the UK was part of the EU.

Now, as well as having the correct postage, all items apart from documents sent from England, Scotland and Wales to the EU need an extra customs declaration form attached.

The form asks for the sender and recipient’s details, whether the item is a gift or an item sent for sale (which affects the level of duty for some countries) and a detailed description of what is in it. The form is available to download here.

Janet, 60, in Cologne, said she had to pay almost €8 to pick up a scarf from the UK that cost less than this amount.

"We have asked our family and friends not to send us stuff," she said.

James East, 39, in Berlin said he had to pay a fee of €1.37 for a magazine that was said to be worth £6. He also had to pay the €6 DHL service fee.

"I don't think there was a mistake, although I still think it's wrong," said East, who added that the "the admin fees from Deutsche Post, FedEx, etc are way out of proportion".

Sonny, 34, in Dusseldorf had to pay €8 for a "pair of socks and lapel pin".

"Will never buy anything from UK, ever," he said. "Doesn't make any sense at all to pay €15 for a pair of socks, and pay €8 on top. DHL also didn't bring it to my address and I had to go to a branch because of the customs fee."

Joseph, was charged €12 for a 3kg package from the UK. He said this was a repeat order - and the previous time he received the same order without charges (also in the post-Brexit period).

"It's very hit and miss on if charges are applied (when they should be), and when charges are applied (when they definitely should NOT be)," he said.

He recommended ordering from Ireland if products are available there to avoid extra fees.

The costs also come as a surprise to many people.

Alisa, 25, in Hamburg, said: "I was not aware of the introduction of the customs fee for parcels from UK. As a vinyl collector, it really annoys me to pay extra for the items I already pay a delivery fee on."

Another reader, Angie, 50, in Düsseldorf said she was charged €122 for a painting that was a gift from loved ones in Canada.

"We tell all our family to please not send anything," said Angie.

Elspeth, 39, in Hesse, said she was charged €17 to pick up a book sent from the UK, including the admin fee.

"The book was a free copy sent to me by the author as a thank you for my contribution to the book, but customs simply took the recommended retail price (RRP) off the book and charged me a percentage," she said.

The Local has approached DHL for a comment on some of these issues but we have not yet received a response.

*******

Thanks to everyone who shared their experience with us. Although we weren’t able to include all the submissions, we read each of them and are sincerely grateful to everybody who took the time to fill in the survey.

If there’s anything you’d like to ask or tell us about our coverage, please feel free to get in touch.

Comments (1)

See Also

In a survey asking for your experiences, 94.5 percent of nearly 100 people who replied to us said they had to pay customs fees before receiving their parcel in Germany.

Around 33 percent of the responses came from people receiving packages from the UK to Germany. Other countries where packages with customs charges were mentioned frequently were Hong Kong, the USA and India.

Most readers told us the fees were a surprise to them, and many said they felt they shouldn't have been charged.

Others raised questions over the administrative fee or Auslagepauschale (usually around €6).

'Ridiculous amount'

The EU’s taxation and customs union website says that private packages with a value of up to €45 “are not subject to prohibitions or restrictions,” and Germany’s customs and finance authority has also confirmed that gifts of up to €45 are not subject to customs duty or VAT charges.

Many readers said they shouldn't have had to pay any customs fees.

Rebecca, 24, in Stuttgart said she received a 4kg parcel from the UK valued at £21 and was charged €4.67 customs fees plus the €6 handling cost.

"This parcel was of old things I already owned, and was below the customs value so I shouldn't have had to pay anything, let alone pay half the value of the contents again in customs, it was a ridiculous amount," she said.

"I didn't understand why I was paying so much or what the difference between Zoll (customs duty) and Auslagepauschale (handling fee) was, but I knew if I tried to question it at the post office I wouldn't understand the explanation either, so I just paid the amount."

Martin, 37, Zwickau, was charged €8.26 in total (including the service fee) for a £10 gift sent from the UK.

"The CN22 (customs) form was declared as a £10 gift," he explained. "VAT should not have applied as it was below €45.

'Angry and hopeless'

People sending packages from non-EU countries have always had to deal with duty fees and customs declarations, but several readers from countries, including Hong Kong and the USA, told us they have recently been hit with unexpected charges..

This may be linked to a change regarding fees last year. Until June 30th, 2021, packages imported into the EU with a value of less than €22 were exempt from import VAT charges. That exemption was shelved on July 1st, meaning that VAT is now due on all goods imported into the bloc.

But, as we mentioned, that should not apply to private packages or gifts under €45.

Abbie, 34, in Dresden said she was charged a €2 custom fee by DHL, plus the €6 handling fee, to receive a gift from a friend in Hong Kong.

"It's robbery," she said. "I actually asked my friends and family not to send me anything anymore, although it's the only way they can show me physical love during the pandemic."

READ ALSO: Why people in Germany are being charged to receive small packages from outside the EU

Vivian, 54, in Biberach, south-west Germany, said she regularly receives post from Australia and Malaysia. She had to pay €9 in fees for a €29 gift.

Doris, 37, in Berlin, said she was charged €2.10 plus a €6 admin charge to pick up a parcel that weighed 1kg from Hong Kong.

"It was used clothes and a small gift from a friend for our newborn baby," she said. "It was written clearly on the parcel that it's gift. It is worth €10 only, but we were still charged a total of €8,10. We found it quite ridiculous."

Alyssa, 33, in Hamburg said she was charged a fee to receive a hand crocheted blanket by her grandma sent from the USA.

She said authorities "basically held it ransom for €50".

Claudia, 29, in Troisdorf said she felt "angry and hopeless" at having to pay high fees on packages from Hong Kong.

"I feel like there is no one who can help me in the situation, even though I have made a complaint," she said.

Yi, 34, said they had to pay around €14 to get a package containing "my books and some snacks from my home city" in Hong Kong

Meanwhile, a 40-year-old in Mainz, who described the system of customs fees and administrative charges in Germany as a "total disaster" said they suspected issues around discrimination and racism.

"I've heard that it would help if the name of the receiver is a German or English name - basically not Asia-oriented. I haven't tried as my husband and me are both from Hong Kong."

'I will never buy anything from UK'

For people receiving packages from the UK, this is a fairly new issue. Before Brexit, duty fees did not apply because the UK was part of the EU.

Now, as well as having the correct postage, all items apart from documents sent from England, Scotland and Wales to the EU need an extra customs declaration form attached.

The form asks for the sender and recipient’s details, whether the item is a gift or an item sent for sale (which affects the level of duty for some countries) and a detailed description of what is in it. The form is available to download here.

Janet, 60, in Cologne, said she had to pay almost €8 to pick up a scarf from the UK that cost less than this amount.

"We have asked our family and friends not to send us stuff," she said.

James East, 39, in Berlin said he had to pay a fee of €1.37 for a magazine that was said to be worth £6. He also had to pay the €6 DHL service fee.

"I don't think there was a mistake, although I still think it's wrong," said East, who added that the "the admin fees from Deutsche Post, FedEx, etc are way out of proportion".

Sonny, 34, in Dusseldorf had to pay €8 for a "pair of socks and lapel pin".

"Will never buy anything from UK, ever," he said. "Doesn't make any sense at all to pay €15 for a pair of socks, and pay €8 on top. DHL also didn't bring it to my address and I had to go to a branch because of the customs fee."

Joseph, was charged €12 for a 3kg package from the UK. He said this was a repeat order - and the previous time he received the same order without charges (also in the post-Brexit period).

"It's very hit and miss on if charges are applied (when they should be), and when charges are applied (when they definitely should NOT be)," he said.

He recommended ordering from Ireland if products are available there to avoid extra fees.

The costs also come as a surprise to many people.

Alisa, 25, in Hamburg, said: "I was not aware of the introduction of the customs fee for parcels from UK. As a vinyl collector, it really annoys me to pay extra for the items I already pay a delivery fee on."

Another reader, Angie, 50, in Düsseldorf said she was charged €122 for a painting that was a gift from loved ones in Canada.

"We tell all our family to please not send anything," said Angie.

Elspeth, 39, in Hesse, said she was charged €17 to pick up a book sent from the UK, including the admin fee.

"The book was a free copy sent to me by the author as a thank you for my contribution to the book, but customs simply took the recommended retail price (RRP) off the book and charged me a percentage," she said.

The Local has approached DHL for a comment on some of these issues but we have not yet received a response.

*******

Thanks to everyone who shared their experience with us. Although we weren’t able to include all the submissions, we read each of them and are sincerely grateful to everybody who took the time to fill in the survey.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.