Housing: How did it get so expensive to live in Munich?

As one of the most lush and liveable cities in Germany, it's no wonder the Bavarian capital is so desirable. But this alone does not account for skyrocketing prices.

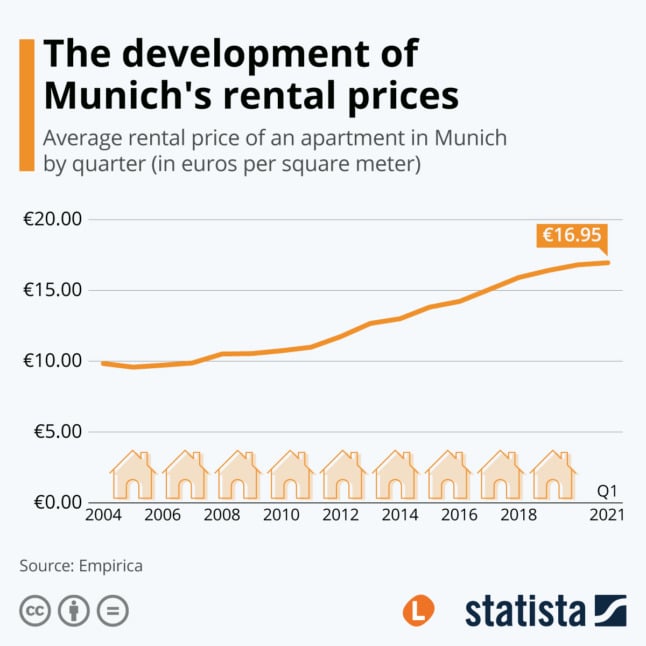

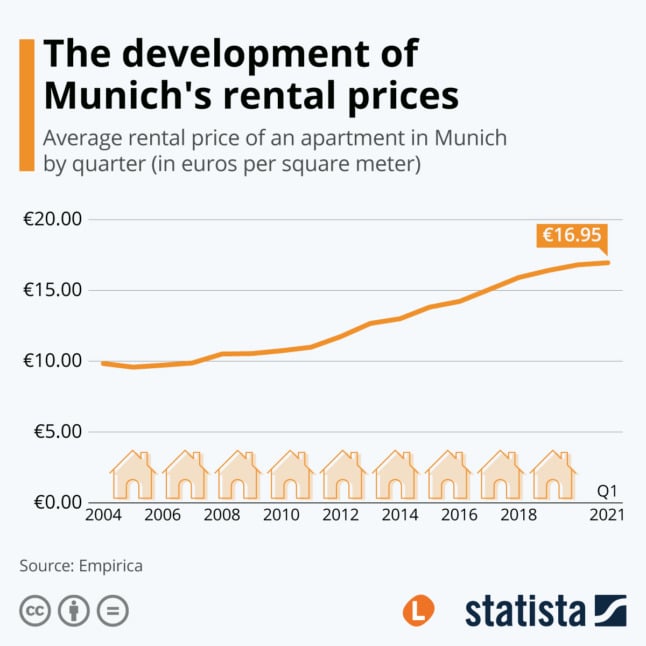

Living in Munich has never been cheap in comparison to other German cities. But in the last 12 years, the average rental price per square meter here has made quite a leap - from around €10 in 2008 to scratching the €17 mark in 2020.

And until 2018 it had proudly held the title of Germany’s most expensive city for 20 years. But why exactly is Munich so expensive?

Supply and demand

The most cited explanation for what generally pushes up prices is quite simple: supply and demand. “It is true that the population of Munich keeps growing every year," Bing Zhu, a professor for real estate development at Munich’s Technical University, told the Local.

Last year, however, the pandemic interrupted the city's constant population growth. According to Bavaria’s State Office of Statistics, for the first time in 10 years, fewer people moved to Munich than away from it in 2020.

Its population still grew slightly, as more babies were born than inhabitants passed away.

Furthermore, 2020 was a record year for residential construction with 8,300 objects being finished - 16.4 percent more than in 2019.

But a lower population growth - and more available housing - doesn’t automatically indicate a relaxation on the market.

READ ALSO: Rent prices for new Munich flats rise to over €20 per square metre

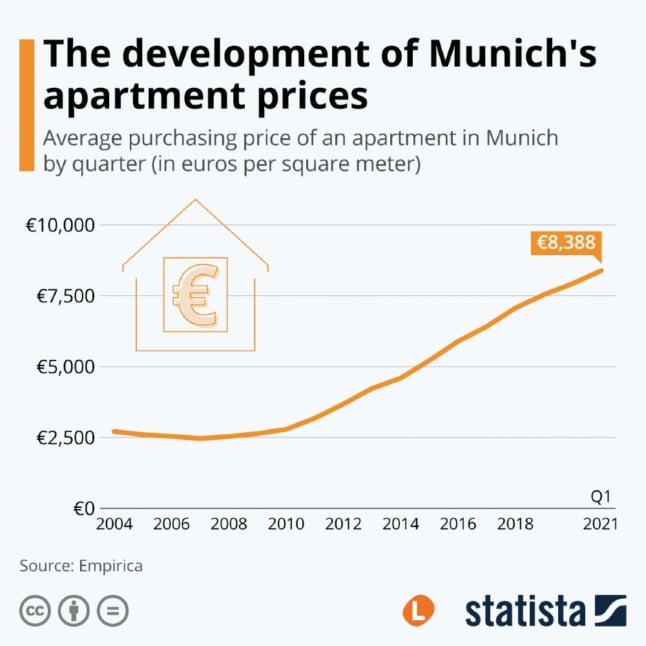

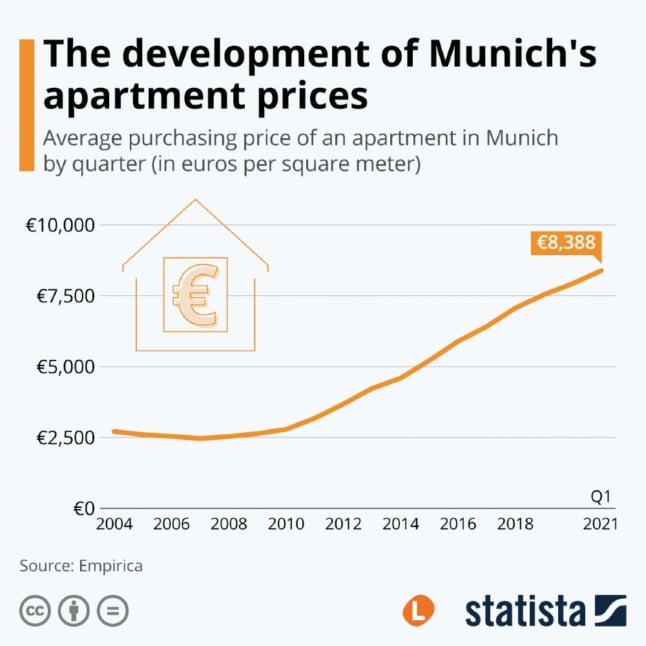

Graph prepared for The Local by Statista.

An important factor: interest rates

There are multiple reasons why an instant decline in rent prices would be unrealistic. According to Zhu, macroeconomic factors heavily influence prices on the residential market.

“We call this the quick and dirty way to evaluate prices," she said with a smile. “But if interest rates on the market are low, while other factors remain constant, real estate prices will be high.”

For both investors and private home buyers, low interest rates make an investment in "concrete gold" more attractive. For private home buyers, taking out credit with low interest rates might just enable them to make an investment like that.

Since 2008, both the lending and deposit facilities of the European Central Bank, which have an influence on all other interest rates on the market, have dropped significantly.

Until July 2008, just before the worldwide financial crisis, the lending facility had reached 5.25 percent. By January 2009 the rate had fallen to three percent and - after the crisis really hit home - step by step dropped further to just 0.25 percent in September 2019.

During that same time the median buying price for one square metre in Munich rose from €2,970 to €7,500 according to Immowelt - a steep increase of 153 percent.

While at first lower interest rates gave private homeowners a new opportunity, high prices eventually paved the way for a different type of buyer: investors.

Selling off rent-controlled apartments

With traditional investments like government bonds becoming less lucrative, new investment opportunities needed to be tapped into. While stock prices bounced back quite quickly after the crisis, they were never really a low risk asset.

Yet residential property checks all the boxes: safe, quite easily available and profitable.

And there’s an additional bonus: the Bavarian state bank BayernLB was in massive trouble after the crisis. Like many other European banks they had invested in defaulted financial products issued by American banks and were now on the verge of bankruptcy. As a consequence, it was forced to at least try to outweigh their losses by selling assets.

Among them were 33,000 apartments with approximately 80,000 renters living in them. In 2013 they were sold to an investor, and 30,000 formerly rent controlled apartments entered the free market. This is not the only case of state-owned real estate being sold to investors, but it was at the time a scandalous one.

Graph prepared for The Local by Statista.

Of course, to achieve profitability, the revenues generated need to grow. And with rent being the main cash flow, it has to rise - especially when the buying price for a building is already quite high. This is exactly what has happened: a new record every year for more than a decade.

In 2009, southern Germany’s leading newspaper Süddeutsche Zeitung (SZ) wrote: “Record rents: Living in Munich has never been as expensive as it is at present. Last year, prices rose by up to 9.1 percent” - to €13 at the time.

An article from 2013 contained almost the same wording: “Rents for new leases in Munich have once again reached a historic all-time high in the past six months. At €14.90 (per square meter), rents for old buildings are scraping the €15 mark”

Meanwhile, a new record has been set, as the SZ wrote in 2021: “For almost 85 percent of all new leases, the price is currently €15 or more per square meter. Newly built apartments with good housing value have reached the mark of €20 per square meter.”

READ ALSO: It's not impossible: How to find housing in Munich

Buying prices influence rental costs

Rising rental prices are a consequence of buying prices also going up. This becomes even more apparent if you look at the so-called rental price ratio.

In 2010, this ratio stood at 25 for the purchase of an average rental condo, meaning that the buying price is 25 times the annual rent in Munich.

By 2019 this index had risen to 41.6. According to Zhu, buying property with the purpose of renting it out might therefore become more and more unattractive - even for investors.

This might be an indicator for a real estate bubble, when the price of housing skyrockets due to supply and demand, and is further pushed up by speculative buying. According to the UBS bank’s Global Real Estate Bubble Report 2019, Munich has the highest risk of all cities worldwide to be caught in such a bubble.

However, as demand is still higher than supply, an imminent burst doesn’t seem expected. For investors, Zhu says, whether it’s a bubble or not is not that important - it's only important to know the timing when the prices reach their turning point, and most likely to sell beforehand.

So if investing in real estate is no longer as profitable as it once was - who is still doing it? According to an investigation by Bayerischer Rundfunk BR, around 70,000 apartments in Munich are held by the state.

Property rental companies listed on the stock exchange, Deutsche Wohnen and Vonovia being the biggest two, make up only a small fraction of the market. Private landlords and medium-sized firms make up the biggest fraction on the market.

However, as the investigation found out, there is a lack of transparency and questionable business practices.

Sometimes, investors buy a building not for the building itself but for the land it's on. Their plan: To either convert a house with multiple rentals into separately sold condos, or to tear it down and build an entirely new building.

Even just having a permit from the city that would theoretically allow such measures can be worth a lot of money.

For example, in 2017 a group of heirs sold an apartment house they’d inherited to a real estate developer for €12 million. Shortly after, one of the renters found a development plan for the building online: The new owner wanted to get a permit for the demolition and the construction of a new house, and then sell the original building again with the two permits.

The estimated price of sale was €28 million. This was a highly speculative deal, counting on the probability that Munich will continue to become more and more expensive, eventually making the construction of a new building profitable.

Improving not only housing, but infrastructure

Besides macroeconomic characteristics like interest rates and speculative market practices, there is another factor that makes Munich so expensive: the quality of open spaces and how they are spread around town, Alain Thierstein, a Professor for Urban Development at the Technical University of Munich, told The Local.

The most famous one is perhaps the English Garden, an inner city park that is even bigger than New York’s Central Park.

One central step to increasing equality within the city, and to absorbing price shocks in very expensive areas, according to Thierstein, is “creating a polycentric structure”.

Munich today is essentially a circle with a horizontal axis through its middle, the so-called Stammstrecke, with the city centre lined up like pearls on a necklace.

The problem: The further away from this axis, the less attractive the location. There are still areas in Munich that are relatively cheap, like Feldmoching. But they also suffer from an - in comparison - expendable infrastructure.

This increases the concentration of demand, and therefore the market pressure, on areas with a better infrastructure.

An idea to combat this might be the concept of the 15 minute city, where all essential infrastructure as well as access to public transportation should be available within 15 minutes from one's home.

"A city doesn’t only consist of its buildings”, said Thierstein, “but also of its infrastructure".

By Lisa Schneider

Comments (1)

See Also

Living in Munich has never been cheap in comparison to other German cities. But in the last 12 years, the average rental price per square meter here has made quite a leap - from around €10 in 2008 to scratching the €17 mark in 2020.

And until 2018 it had proudly held the title of Germany’s most expensive city for 20 years. But why exactly is Munich so expensive?

Supply and demand

The most cited explanation for what generally pushes up prices is quite simple: supply and demand. “It is true that the population of Munich keeps growing every year," Bing Zhu, a professor for real estate development at Munich’s Technical University, told the Local.

Last year, however, the pandemic interrupted the city's constant population growth. According to Bavaria’s State Office of Statistics, for the first time in 10 years, fewer people moved to Munich than away from it in 2020.

Its population still grew slightly, as more babies were born than inhabitants passed away.

Furthermore, 2020 was a record year for residential construction with 8,300 objects being finished - 16.4 percent more than in 2019.

But a lower population growth - and more available housing - doesn’t automatically indicate a relaxation on the market.

READ ALSO: Rent prices for new Munich flats rise to over €20 per square metre

Graph prepared for The Local by Statista.

An important factor: interest rates

There are multiple reasons why an instant decline in rent prices would be unrealistic. According to Zhu, macroeconomic factors heavily influence prices on the residential market.

“We call this the quick and dirty way to evaluate prices," she said with a smile. “But if interest rates on the market are low, while other factors remain constant, real estate prices will be high.”

For both investors and private home buyers, low interest rates make an investment in "concrete gold" more attractive. For private home buyers, taking out credit with low interest rates might just enable them to make an investment like that.

Since 2008, both the lending and deposit facilities of the European Central Bank, which have an influence on all other interest rates on the market, have dropped significantly.

Until July 2008, just before the worldwide financial crisis, the lending facility had reached 5.25 percent. By January 2009 the rate had fallen to three percent and - after the crisis really hit home - step by step dropped further to just 0.25 percent in September 2019.

During that same time the median buying price for one square metre in Munich rose from €2,970 to €7,500 according to Immowelt - a steep increase of 153 percent.

While at first lower interest rates gave private homeowners a new opportunity, high prices eventually paved the way for a different type of buyer: investors.

Selling off rent-controlled apartments

With traditional investments like government bonds becoming less lucrative, new investment opportunities needed to be tapped into. While stock prices bounced back quite quickly after the crisis, they were never really a low risk asset.

Yet residential property checks all the boxes: safe, quite easily available and profitable.

And there’s an additional bonus: the Bavarian state bank BayernLB was in massive trouble after the crisis. Like many other European banks they had invested in defaulted financial products issued by American banks and were now on the verge of bankruptcy. As a consequence, it was forced to at least try to outweigh their losses by selling assets.

Among them were 33,000 apartments with approximately 80,000 renters living in them. In 2013 they were sold to an investor, and 30,000 formerly rent controlled apartments entered the free market. This is not the only case of state-owned real estate being sold to investors, but it was at the time a scandalous one.

Graph prepared for The Local by Statista.

Of course, to achieve profitability, the revenues generated need to grow. And with rent being the main cash flow, it has to rise - especially when the buying price for a building is already quite high. This is exactly what has happened: a new record every year for more than a decade.

In 2009, southern Germany’s leading newspaper Süddeutsche Zeitung (SZ) wrote: “Record rents: Living in Munich has never been as expensive as it is at present. Last year, prices rose by up to 9.1 percent” - to €13 at the time.

An article from 2013 contained almost the same wording: “Rents for new leases in Munich have once again reached a historic all-time high in the past six months. At €14.90 (per square meter), rents for old buildings are scraping the €15 mark”

Meanwhile, a new record has been set, as the SZ wrote in 2021: “For almost 85 percent of all new leases, the price is currently €15 or more per square meter. Newly built apartments with good housing value have reached the mark of €20 per square meter.”

READ ALSO: It's not impossible: How to find housing in Munich

Buying prices influence rental costs

Rising rental prices are a consequence of buying prices also going up. This becomes even more apparent if you look at the so-called rental price ratio.

In 2010, this ratio stood at 25 for the purchase of an average rental condo, meaning that the buying price is 25 times the annual rent in Munich.

By 2019 this index had risen to 41.6. According to Zhu, buying property with the purpose of renting it out might therefore become more and more unattractive - even for investors.

This might be an indicator for a real estate bubble, when the price of housing skyrockets due to supply and demand, and is further pushed up by speculative buying. According to the UBS bank’s Global Real Estate Bubble Report 2019, Munich has the highest risk of all cities worldwide to be caught in such a bubble.

However, as demand is still higher than supply, an imminent burst doesn’t seem expected. For investors, Zhu says, whether it’s a bubble or not is not that important - it's only important to know the timing when the prices reach their turning point, and most likely to sell beforehand.

So if investing in real estate is no longer as profitable as it once was - who is still doing it? According to an investigation by Bayerischer Rundfunk BR, around 70,000 apartments in Munich are held by the state.

Property rental companies listed on the stock exchange, Deutsche Wohnen and Vonovia being the biggest two, make up only a small fraction of the market. Private landlords and medium-sized firms make up the biggest fraction on the market.

However, as the investigation found out, there is a lack of transparency and questionable business practices.

Sometimes, investors buy a building not for the building itself but for the land it's on. Their plan: To either convert a house with multiple rentals into separately sold condos, or to tear it down and build an entirely new building.

Even just having a permit from the city that would theoretically allow such measures can be worth a lot of money.

For example, in 2017 a group of heirs sold an apartment house they’d inherited to a real estate developer for €12 million. Shortly after, one of the renters found a development plan for the building online: The new owner wanted to get a permit for the demolition and the construction of a new house, and then sell the original building again with the two permits.

The estimated price of sale was €28 million. This was a highly speculative deal, counting on the probability that Munich will continue to become more and more expensive, eventually making the construction of a new building profitable.

Improving not only housing, but infrastructure

Besides macroeconomic characteristics like interest rates and speculative market practices, there is another factor that makes Munich so expensive: the quality of open spaces and how they are spread around town, Alain Thierstein, a Professor for Urban Development at the Technical University of Munich, told The Local.

The most famous one is perhaps the English Garden, an inner city park that is even bigger than New York’s Central Park.

One central step to increasing equality within the city, and to absorbing price shocks in very expensive areas, according to Thierstein, is “creating a polycentric structure”.

Munich today is essentially a circle with a horizontal axis through its middle, the so-called Stammstrecke, with the city centre lined up like pearls on a necklace.

The problem: The further away from this axis, the less attractive the location. There are still areas in Munich that are relatively cheap, like Feldmoching. But they also suffer from an - in comparison - expendable infrastructure.

This increases the concentration of demand, and therefore the market pressure, on areas with a better infrastructure.

An idea to combat this might be the concept of the 15 minute city, where all essential infrastructure as well as access to public transportation should be available within 15 minutes from one's home.

"A city doesn’t only consist of its buildings”, said Thierstein, “but also of its infrastructure".

By Lisa Schneider

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.