Student housing prices in Germany increasing up to 70 percent: study

Flats in university cities in Germany are becoming increasingly more expensive. Since 2010, prices have risen between 9.8 percent (Griefswald) and 67.3 percent (Berlin), according to a student price index published on Monday by the German Economic Institute in Cologne.

In the past year alone, rent prices have increased by 2.2 percent in Griefswald and 9.8 percent in Berlin.

“More needs to be built, but this alone can’t stop the quickly growing prices of big cities,” said study director Michael Voigtländer.

Students in Munich pay the most, an average of €600 per month, followed by Frankfurt am Main at €488 a month. The most affordable flats are in the eastern German city of Magdeburg, with prices set at €200 per month.

The best priced university cities, where students can still snag accommodation for under €300 per month, are Leipzig, Jena, Greifswald, Kiel, Göttingen und Aachen.

SEE ALSO: Weekend wanderlust: A walk through the Nobel trail of Göttingen

The study includes an interactive map of Germany in which showcases how much flats 20 to 40 square meters costs based on if they are furnished or not, and how far they are located from an university.

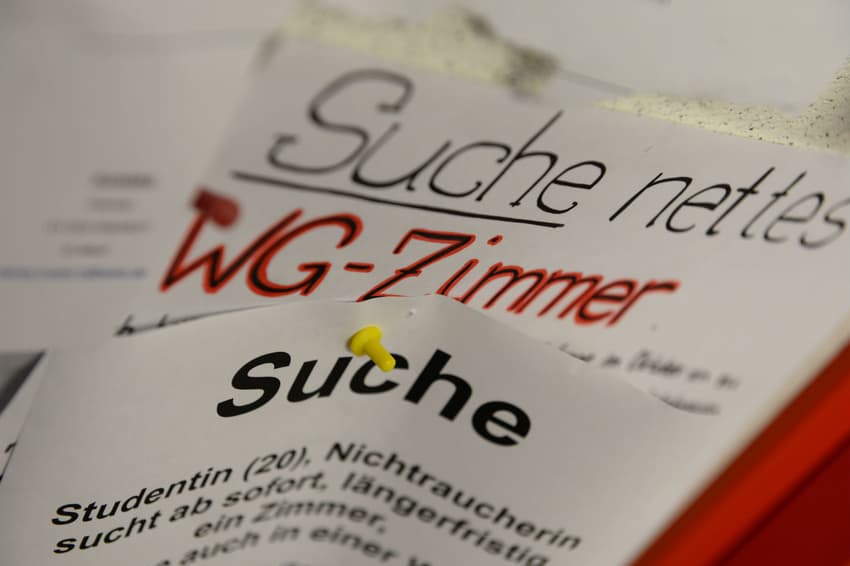

The study is based on data from the websites Immobilienscout24 and wg-suche.de. The Economic Institute wanted to investigate what advertisements students would find if they moved to a new city, did not receive a dorm room, and relied solely on online services. "The number of listings is still high, but declining," said Voigtländer.

In addition to the strong demand for housing in large cities, there is another reason for the rapid rise in prices, according to the Economic Institute: "The furnishings of the apartments have improved," Voigtländer said, pointing out that the quality of new buildings is higher than in the past.

According to the latest study from the Deutsches Studentenwerk (German Association for Student Affairs), students have €918 at their disposal per month. In 2012, the average was still €842 - so income has only risen by around nine percent since then.

Depending on the university location, students foot down between one and two thirds of their monthly budget on rent.

Meanwhile, the number of students in Berlin, the Ruhr area, Munich, Cologne and Hamburg has risen sharply. In the winter semester 2010/2011, 2.22 million people attended universities there, compared to 2.84 million in the previous winter semester.

SEE ALSO: In graphs: Number of international students in Germany quickly growing

For this reason, first-semester students were increasingly considering whether they wanted to study in cities with fewer students, says Voigtländer.

The expert sees opportunities in this development: In Germany there are numerous regions that have a considerable need for skilled workers, but where rents are significantly more affordable, states the study.

Examples of this are the regions around Jena, Upper Franconia or South Westphalia. But it is not only students who benefit from the comparatively lower rents there: Because the universities trained the young people and they often stayed in the region after their studies, the region also profited from the influx.

SEE ALSO: East German boom town breaks populist, backward stereotype

It was also said that the universities were that secured competitive advantages for local companies.

Nevertheless, according to the study there are clear regional differences: not all university locations have grown - in the East German cities of Jena, Magdeburg and Greifswald there are even fewer students today than seven years ago.

Comments

See Also

In the past year alone, rent prices have increased by 2.2 percent in Griefswald and 9.8 percent in Berlin.

“More needs to be built, but this alone can’t stop the quickly growing prices of big cities,” said study director Michael Voigtländer.

Students in Munich pay the most, an average of €600 per month, followed by Frankfurt am Main at €488 a month. The most affordable flats are in the eastern German city of Magdeburg, with prices set at €200 per month.

The best priced university cities, where students can still snag accommodation for under €300 per month, are Leipzig, Jena, Greifswald, Kiel, Göttingen und Aachen.

SEE ALSO: Weekend wanderlust: A walk through the Nobel trail of Göttingen

The study includes an interactive map of Germany in which showcases how much flats 20 to 40 square meters costs based on if they are furnished or not, and how far they are located from an university.

The study is based on data from the websites Immobilienscout24 and wg-suche.de. The Economic Institute wanted to investigate what advertisements students would find if they moved to a new city, did not receive a dorm room, and relied solely on online services. "The number of listings is still high, but declining," said Voigtländer.

In addition to the strong demand for housing in large cities, there is another reason for the rapid rise in prices, according to the Economic Institute: "The furnishings of the apartments have improved," Voigtländer said, pointing out that the quality of new buildings is higher than in the past.

According to the latest study from the Deutsches Studentenwerk (German Association for Student Affairs), students have €918 at their disposal per month. In 2012, the average was still €842 - so income has only risen by around nine percent since then.

Depending on the university location, students foot down between one and two thirds of their monthly budget on rent.

Meanwhile, the number of students in Berlin, the Ruhr area, Munich, Cologne and Hamburg has risen sharply. In the winter semester 2010/2011, 2.22 million people attended universities there, compared to 2.84 million in the previous winter semester.

SEE ALSO: In graphs: Number of international students in Germany quickly growing

For this reason, first-semester students were increasingly considering whether they wanted to study in cities with fewer students, says Voigtländer.

The expert sees opportunities in this development: In Germany there are numerous regions that have a considerable need for skilled workers, but where rents are significantly more affordable, states the study.

Examples of this are the regions around Jena, Upper Franconia or South Westphalia. But it is not only students who benefit from the comparatively lower rents there: Because the universities trained the young people and they often stayed in the region after their studies, the region also profited from the influx.

SEE ALSO: East German boom town breaks populist, backward stereotype

It was also said that the universities were that secured competitive advantages for local companies.

Nevertheless, according to the study there are clear regional differences: not all university locations have grown - in the East German cities of Jena, Magdeburg and Greifswald there are even fewer students today than seven years ago.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.