Germany's most expensive luxury flat sold in Berlin

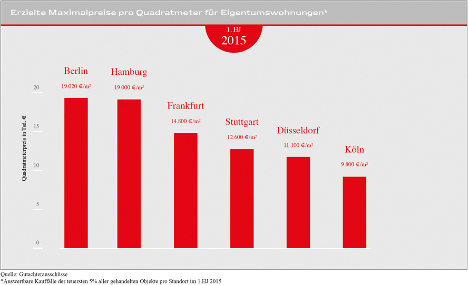

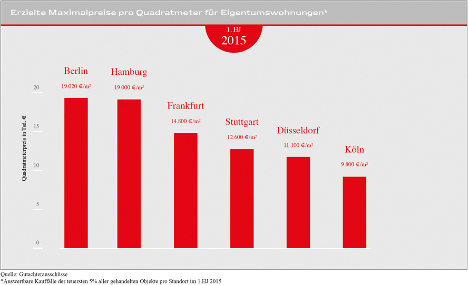

Is the capital no longer "poor but sexy"? Berlin has sold off the most expensive flat in Germany at more than €19,000 per square meter.

The priciest flat by space in Germany was not sold to the elites in business-rich Bavaria, nor in the billionaire-dense port city of Hamburg.

Berlin, whose unemployment rate stands at twice the national average, holds the title of selling the most expensive apartment on the German market, according to Engel & Völkers real estate agency.

That flat was sold recently for a whopping €19,018 per square metre in the central Mitte district, newspaper B-Z reported on Tuesday.

This put it slightly ahead of the most expensive flat in Hamburg at €19,000 per square meter.

Engel & Völkers had recently released an analysis of the German luxury flat market, examining trends from apartments on sale in the first half of last year.

"Many new real estate developments in recent years have seen Berlin catch up considerably in the premium market segment," wrote Engel & Völkers in the report.

But Berlin, dubbed "poor but sexy" by former mayor Klaus Wowereit, still has some catching up to do to be overall on par with its richer rivals in the north and south.

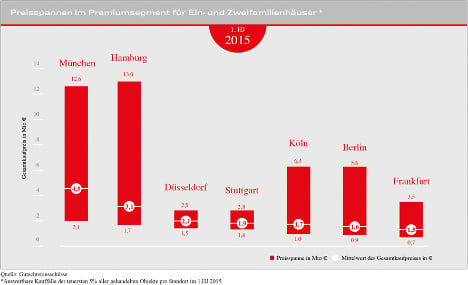

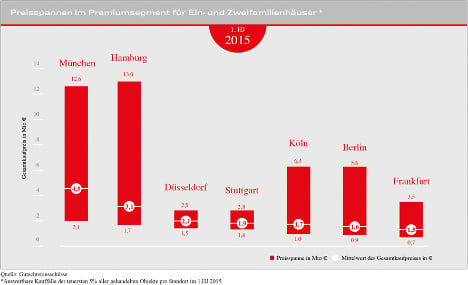

While Berlin's ritzy Mitte flat was the most expensive by price per square meter, Hamburg topped the charts for having the most expensive flat in absolute terms at €13 million, followed by one in Munich at €12.6 million. The most expensive flat on the market in Berlin during this time period was €5.6 million.

In 2014, Berlin set a record when it sold a €5.7 million apartment in Mitte.

But the Bavarian capital last year did have the highest average prices for luxury flats (defined by Engel & Völkers as the highest five percent of the market). Munich "dream homes" average €4.5 million, compared to €1.6 million on average on Berlin.

Germany overall has been experiencing a bit of a housing boom, with more building permits this year during the month of January than in the past decade.

"Over the course of this year, we expect demand for top properties to remain high and prices to rise," said Kai Enders of the real estate agency's management board in a statement.

"Market developments will also be helped along by intensified building activity in the premium segment and a lack of investment alternatives.”

Comments

See Also

The priciest flat by space in Germany was not sold to the elites in business-rich Bavaria, nor in the billionaire-dense port city of Hamburg.

Berlin, whose unemployment rate stands at twice the national average, holds the title of selling the most expensive apartment on the German market, according to Engel & Völkers real estate agency.

That flat was sold recently for a whopping €19,018 per square metre in the central Mitte district, newspaper B-Z reported on Tuesday.

This put it slightly ahead of the most expensive flat in Hamburg at €19,000 per square meter.

Engel & Völkers had recently released an analysis of the German luxury flat market, examining trends from apartments on sale in the first half of last year.

"Many new real estate developments in recent years have seen Berlin catch up considerably in the premium market segment," wrote Engel & Völkers in the report.

But Berlin, dubbed "poor but sexy" by former mayor Klaus Wowereit, still has some catching up to do to be overall on par with its richer rivals in the north and south.

While Berlin's ritzy Mitte flat was the most expensive by price per square meter, Hamburg topped the charts for having the most expensive flat in absolute terms at €13 million, followed by one in Munich at €12.6 million. The most expensive flat on the market in Berlin during this time period was €5.6 million.

In 2014, Berlin set a record when it sold a €5.7 million apartment in Mitte.

But the Bavarian capital last year did have the highest average prices for luxury flats (defined by Engel & Völkers as the highest five percent of the market). Munich "dream homes" average €4.5 million, compared to €1.6 million on average on Berlin.

Germany overall has been experiencing a bit of a housing boom, with more building permits this year during the month of January than in the past decade.

"Over the course of this year, we expect demand for top properties to remain high and prices to rise," said Kai Enders of the real estate agency's management board in a statement.

"Market developments will also be helped along by intensified building activity in the premium segment and a lack of investment alternatives.”

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.