Germans save a lot, but save badly

Germany has prided itself on its ability to weather the global financial crisis, but a report reveals Germans trail other Europeans in investing for the future thanks to poor decision making.

The Global Wealth Report released on Tuesday by insurance group Allianz shows that while Germany has been one of the few countries where people have worked harder to save money throughout the financial crisis, Germans lag behind others in accumulating more assets and investing long-term.

Gross financial assets in Germany grew by four percent last year - slower than the western European average of five percent, despite Germany being labelled "Europe's savings champion".

"Wealth development in Germany is truly mediocre in the truest sense of the word,” said Allianz chief economist Michael Heise. "At the same time, the Germans are above-average savers.

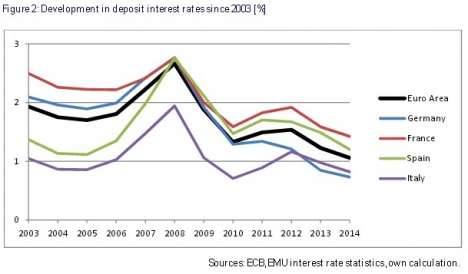

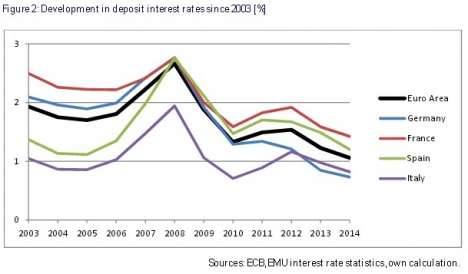

"But it is also the case that almost nobody invests quite as much money with banks as the Germans do, even though bank interest rates are far lower than in the rest of Europe."

In part due to their penchant for stowing all their money away in a low interest savings accounts, Germans have taken some of the biggest losses compared to the rest of Europe during the financial crisis.

The report shows that Germans have lost €23 billion, or about €280 per capita, in what the report defines as interest rate losses - the balance of interest lost through deposits and interest burdens reduced in lending.

"German savers would appear to be stuck in crisis mode and shying away from making investment decisions," said Heise."But the ‘wait-and-see’ policy is tantamount to giving money away. Six years after the collapse of Lehman, it's high time to start thinking about the long term and investing again."

The European Central Bank has kept interest rates low during the economic crisis, reducing the amount people earn on their deposits.

While the ECB’s policy has given a boost to households in more distressed nations, it has in turn hurt German households and hit spending power.

Interest rates have been close to zero, while inflation peaked at three percent in 2008 and has since come down.

"It is not surprising that monetary policy has had this effect,” said Heise. "The strain that has been taken off debtors in southern Europe, in particular, is very much in keeping with what was intended. But it is important not to lose sight of the side effects of the policy, especially for German investors and their retirement savings."

Equality equal

The report also found that wealth distribution in Germany has changed very little since 2000, making Germany a country with a relatively uneven wealth distribution compared to others.

This is likely “one of the relics of the country’s long division into East and West more than anything else,” the report explained.

A study in February by The German Institute for Economic Research and the centre-left Hans-Böckler Foundation, found people in West Germany were more than twice as rich as those in the East, making Germany is one of the most unequal countries in the Eurozone.

SEE ALSO: Where should expats invest in Germany?

By Emma Anderson

Comments

See Also

The Global Wealth Report released on Tuesday by insurance group Allianz shows that while Germany has been one of the few countries where people have worked harder to save money throughout the financial crisis, Germans lag behind others in accumulating more assets and investing long-term.

Gross financial assets in Germany grew by four percent last year - slower than the western European average of five percent, despite Germany being labelled "Europe's savings champion".

"Wealth development in Germany is truly mediocre in the truest sense of the word,” said Allianz chief economist Michael Heise. "At the same time, the Germans are above-average savers.

"But it is also the case that almost nobody invests quite as much money with banks as the Germans do, even though bank interest rates are far lower than in the rest of Europe."

In part due to their penchant for stowing all their money away in a low interest savings accounts, Germans have taken some of the biggest losses compared to the rest of Europe during the financial crisis.

The report shows that Germans have lost €23 billion, or about €280 per capita, in what the report defines as interest rate losses - the balance of interest lost through deposits and interest burdens reduced in lending.

"German savers would appear to be stuck in crisis mode and shying away from making investment decisions," said Heise."But the ‘wait-and-see’ policy is tantamount to giving money away. Six years after the collapse of Lehman, it's high time to start thinking about the long term and investing again."

The European Central Bank has kept interest rates low during the economic crisis, reducing the amount people earn on their deposits.

While the ECB’s policy has given a boost to households in more distressed nations, it has in turn hurt German households and hit spending power.

Interest rates have been close to zero, while inflation peaked at three percent in 2008 and has since come down.

"It is not surprising that monetary policy has had this effect,” said Heise. "The strain that has been taken off debtors in southern Europe, in particular, is very much in keeping with what was intended. But it is important not to lose sight of the side effects of the policy, especially for German investors and their retirement savings."

Equality equal

The report also found that wealth distribution in Germany has changed very little since 2000, making Germany a country with a relatively uneven wealth distribution compared to others.

This is likely “one of the relics of the country’s long division into East and West more than anything else,” the report explained.

A study in February by The German Institute for Economic Research and the centre-left Hans-Böckler Foundation, found people in West Germany were more than twice as rich as those in the East, making Germany is one of the most unequal countries in the Eurozone.

SEE ALSO: Where should expats invest in Germany?

By Emma Anderson

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.