What experts say will happen to the German housing market in 2023

The political events of this year have sent shockwaves through Germany's property market - but will the trend of high interest rates and dropping demand continue into 2023? Here's what the experts have to say.

It's something of a truism that what goes up must come down - and nowhere has this been more evident in recent months than on Germany's property market. For years, it seemed like the trend of soaring prices and high demand would never come to an end - and then 2022 happened.

Russia's invasion of Ukraine and the ensuing energy crisis has driven inflation up to record levels. To try and dampen the rising prices, the European Central Bank (ECB) put a stop to years of low interest rates and introduced rate hikes at a level that almost nobody predicted.

All of this has made mortgages far more expensive at a time when people are feeling the squeeze in other areas of their lives. A shock analysis by the Hamburg-based Gewos Institute for Urban, Regional and Housing Research earlier this year predicted that real estate turnover could fall this year for the first time since 2009.

At the time, Gewos said sales of flats, houses, commercial property and land were likely to sink by seven percent to €313.5 billion and that the number of purchases was expected to drop below 900,000.

READ ALSO: Why Germany's property boom could be coming to an end

The question for prospective buyers and sellers is whether this trend will continue into 2023. Though nobody has access to a crystal ball at the moment, experts have shared their views on how things could develop.

Here's what we can expect next year.

Interest rates could stabilise slightly

At the start of the year, finding a fixed-rate mortgage with an interest rate of under one percent was far from unusual - but those days appear to be behind us now.

By the end of October, the Biallo Construction Money Index was recording peak interest rates of more than four percent, though this has now sunk slightly to 3.5 percent.

Does that mean we've reached the apex of high interest rates - and could they sink back down in 2023? The answer is mixed, according to experts.

"I would not call this a zenith, but rather a plateau on which we are moving," said Alexander Naumann, a real estate expert at the bank 1822Direkt. "In the near future, therefore, we can expect to see rather moderate movements around the level we have reached."

However, Naumann says there's little chance of a return to the rock-bottom interest rates of previous years.

Stefan Kohler, Head of Construction Financing at Allianz, makes a similar prognosis: "Due to declining inflation in the U.S. and increased signals of a recession, smaller interest rate hikes by central banks are to be expected.

"The highest probability is for a scenario in which the interest rate plateau in Europe is reached in the first quarter of 2023."

... but new regulations could still drive up mortgage costs

Just as there seem to be some reprieve from soaring interest rates, the Federal Financial Supervisory Authority (BaFin) is preparing to introduce new rules that could drive up costs for buyers.

Renovated flats in Greifswald, Mecklenburg Western-Pomerania. Photo: picture alliance/dpa | Stefan Sauer

On April 1st, 2023, BaFin will increase the amount of capital banks have to set aside on every real estate loan. Currently banks have to "freeze" seven percent of the loan as collateral and are unable to operate with it. This will increase to 9.75 percent next year - the cost of which could be passed onto customers through less favourable mortgage conditions.

READ ALSO: EXPLAINED: The hidden costs of buying a house in Germany

Flats in big cities increasingly unaffordable

Those dreaming of life in the big smoke with a room (or flat) of their own are finding this dream harder than ever to achieve. Alongside high energy prices and interest rates, a lack of housing in major German cities has meant that people on average salaries are increasingly priced out of the housing market.

Having promised to build 400,000 new homes per year, the government undershot this target significantly in 2022, with just 250,000 new homes expected to be finished by the end of December. In 2023, experts say the number could be even lower at just 200,000.

All of this means that in every second German metropolis, buyers currently need a net salary of more than €5,000 per month to comfortably make repayments on a 90-square-metre flat. This is based on the so-called "housing cost ratio", which states that no more than 30 percent of your salary should be spent on housing per month.

Using this ideal ratio, a study by Immowelt found that much higher-than-average earnings are currently needed to afford a family home in major cities. In Berlin, for example, after-tax earnings of around €8,000 are required for a healthy housing cost ratio. In Cologne, that figure is €8,200, while in Hamburg, it's more than €10,000 and in Munich it's an astounding €14,000.

READ ALSO: EXPLAINED: The German cities where rents are rising fastest this year

Prices could drop slightly - but demand will remain high

With so many headwinds facing the housing market, experts are already seeing prices stagnate and even drop slightly in some areas. According to insurance and housing financing company Debeka, however, the downward pressure on prices differs across regions. "In addition, energy efficiency and the condition of the properties are playing an increasing role," a spokesperson explained.

Stefan Kohler from Allianz believes a number factors will affect whether buyers will see a sustainable drop in prices in 2023. If populations and rents continue to increase while construction remains low, the prices could remain relatively stable.

New properties being build in Rendsburg, Schleswig-Holstein. Slow construction is preventing a steep decline in prices. Photo: picture alliance/dpa | Marcus Brandt

In most cases, the consensus is that slight price corrections should be expected - but nobody is expecting anything as dramatic as the bursting of a housing bubble.

That's because high demand for properties in German cities should clash with the limited supply of properties on offer. So while there could be a slight drop-off in house prices, it may not be that noticeable - and the savings are likely to be eaten up by higher interest rates.

READ ALSO: REVEALED: The German university towns where property prices are going up (and down)

What are the longer term trends?

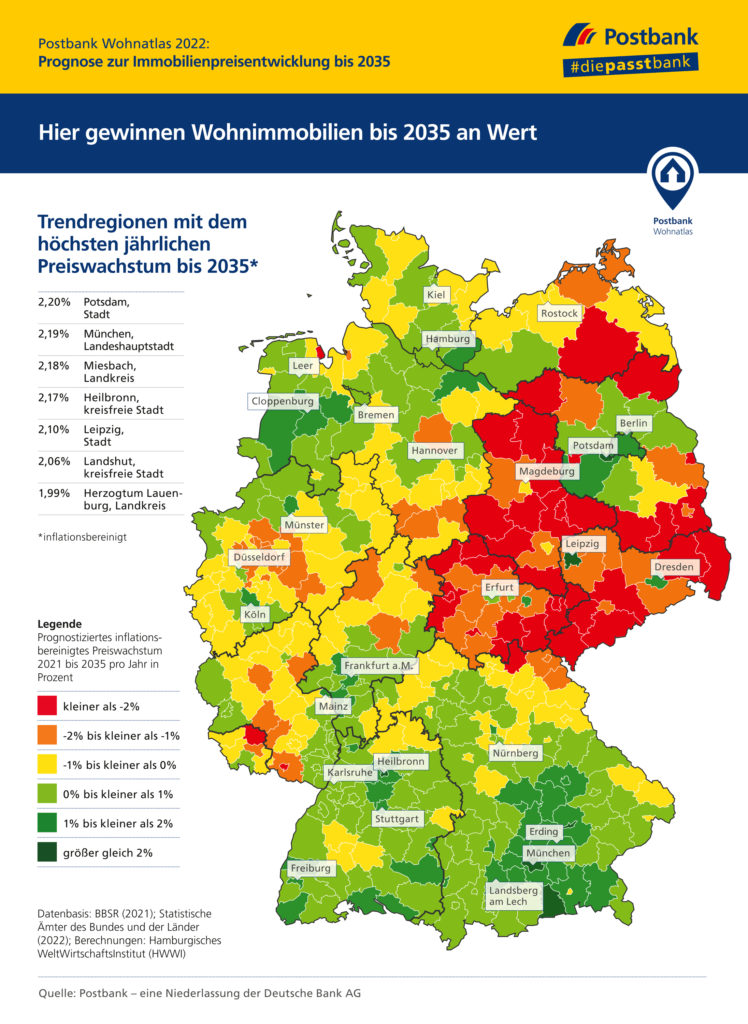

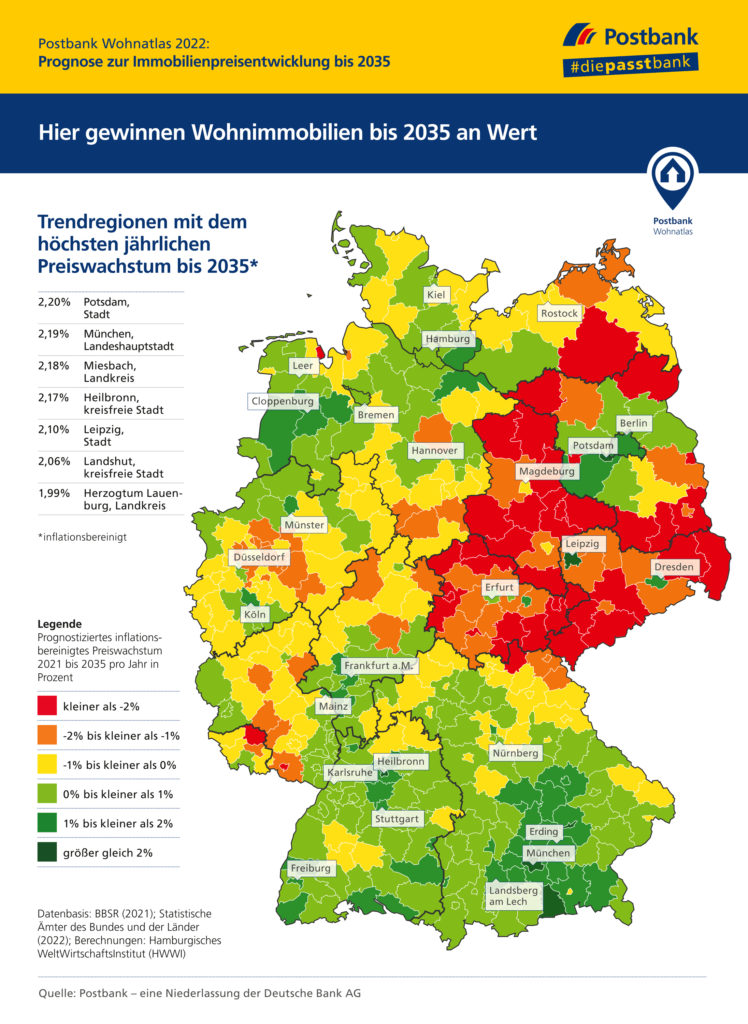

So much for 2023, but what's set to happen to prices over the next ten or fifteen years? Well, things could be looking up - especially for buyers who have already nabbed properties in one of the seven German metropoles, the so-called commuter belt or in trend cities like Leipzig or Dresden.

Indeed, Postbank's "Wohnatlas" predicts price rices of more than two percent per year (adjusted for inflation) until 2035 in many of these areas, with others seeing consistent price rises of between one and two percent.

However, there could be some who see the value of their property decline in the long term. This will primarily affect regions with an aging population such as Saarland, Saxony, Saxony-Anhalt and Thuringia, as well as parts of the Rührgebiet like Gelsenkirchen, Hagen, Duisburg and Bochum.

Nevertheless, buyers who aren't looking for an investment but simply want somewhere to live or some security in their old age could still find good deals in these regions, according to Postbank.

Advice for buyers and sellers

It's hard to know what will happen to the property market too long into the future, but in many regions experts do believe that prices will drop slightly, while interest rates could stabilise in the second half of the year.

This could make it sensible to wait a little before trying to find your dream property, though getting expert advice that's specific to your region and requirements is always a sensible move.

According to real estate firm Heinrichs Immobilien, sellers should plan more time for the sale of their property in the coming years. Rather than expecting it all to be done and dusted with in 3-4 months, these days a sale period of 6-9 months is much more realistic.

The firm also say that sellers should ensure they get an accurate valuation for their property and plan a sensible marketing strategy with their estate agent - as well as leaving plenty of time to find the perfect buyer.

READ ALSO: The rules foreigners need to know when buying property in Germany

Comments

See Also

It's something of a truism that what goes up must come down - and nowhere has this been more evident in recent months than on Germany's property market. For years, it seemed like the trend of soaring prices and high demand would never come to an end - and then 2022 happened.

Russia's invasion of Ukraine and the ensuing energy crisis has driven inflation up to record levels. To try and dampen the rising prices, the European Central Bank (ECB) put a stop to years of low interest rates and introduced rate hikes at a level that almost nobody predicted.

All of this has made mortgages far more expensive at a time when people are feeling the squeeze in other areas of their lives. A shock analysis by the Hamburg-based Gewos Institute for Urban, Regional and Housing Research earlier this year predicted that real estate turnover could fall this year for the first time since 2009.

At the time, Gewos said sales of flats, houses, commercial property and land were likely to sink by seven percent to €313.5 billion and that the number of purchases was expected to drop below 900,000.

READ ALSO: Why Germany's property boom could be coming to an end

The question for prospective buyers and sellers is whether this trend will continue into 2023. Though nobody has access to a crystal ball at the moment, experts have shared their views on how things could develop.

Here's what we can expect next year.

Interest rates could stabilise slightly

At the start of the year, finding a fixed-rate mortgage with an interest rate of under one percent was far from unusual - but those days appear to be behind us now.

By the end of October, the Biallo Construction Money Index was recording peak interest rates of more than four percent, though this has now sunk slightly to 3.5 percent.

Does that mean we've reached the apex of high interest rates - and could they sink back down in 2023? The answer is mixed, according to experts.

"I would not call this a zenith, but rather a plateau on which we are moving," said Alexander Naumann, a real estate expert at the bank 1822Direkt. "In the near future, therefore, we can expect to see rather moderate movements around the level we have reached."

However, Naumann says there's little chance of a return to the rock-bottom interest rates of previous years.

Stefan Kohler, Head of Construction Financing at Allianz, makes a similar prognosis: "Due to declining inflation in the U.S. and increased signals of a recession, smaller interest rate hikes by central banks are to be expected.

"The highest probability is for a scenario in which the interest rate plateau in Europe is reached in the first quarter of 2023."

... but new regulations could still drive up mortgage costs

Just as there seem to be some reprieve from soaring interest rates, the Federal Financial Supervisory Authority (BaFin) is preparing to introduce new rules that could drive up costs for buyers.

On April 1st, 2023, BaFin will increase the amount of capital banks have to set aside on every real estate loan. Currently banks have to "freeze" seven percent of the loan as collateral and are unable to operate with it. This will increase to 9.75 percent next year - the cost of which could be passed onto customers through less favourable mortgage conditions.

READ ALSO: EXPLAINED: The hidden costs of buying a house in Germany

Flats in big cities increasingly unaffordable

Those dreaming of life in the big smoke with a room (or flat) of their own are finding this dream harder than ever to achieve. Alongside high energy prices and interest rates, a lack of housing in major German cities has meant that people on average salaries are increasingly priced out of the housing market.

Having promised to build 400,000 new homes per year, the government undershot this target significantly in 2022, with just 250,000 new homes expected to be finished by the end of December. In 2023, experts say the number could be even lower at just 200,000.

All of this means that in every second German metropolis, buyers currently need a net salary of more than €5,000 per month to comfortably make repayments on a 90-square-metre flat. This is based on the so-called "housing cost ratio", which states that no more than 30 percent of your salary should be spent on housing per month.

Using this ideal ratio, a study by Immowelt found that much higher-than-average earnings are currently needed to afford a family home in major cities. In Berlin, for example, after-tax earnings of around €8,000 are required for a healthy housing cost ratio. In Cologne, that figure is €8,200, while in Hamburg, it's more than €10,000 and in Munich it's an astounding €14,000.

READ ALSO: EXPLAINED: The German cities where rents are rising fastest this year

Prices could drop slightly - but demand will remain high

With so many headwinds facing the housing market, experts are already seeing prices stagnate and even drop slightly in some areas. According to insurance and housing financing company Debeka, however, the downward pressure on prices differs across regions. "In addition, energy efficiency and the condition of the properties are playing an increasing role," a spokesperson explained.

Stefan Kohler from Allianz believes a number factors will affect whether buyers will see a sustainable drop in prices in 2023. If populations and rents continue to increase while construction remains low, the prices could remain relatively stable.

In most cases, the consensus is that slight price corrections should be expected - but nobody is expecting anything as dramatic as the bursting of a housing bubble.

That's because high demand for properties in German cities should clash with the limited supply of properties on offer. So while there could be a slight drop-off in house prices, it may not be that noticeable - and the savings are likely to be eaten up by higher interest rates.

READ ALSO: REVEALED: The German university towns where property prices are going up (and down)

What are the longer term trends?

So much for 2023, but what's set to happen to prices over the next ten or fifteen years? Well, things could be looking up - especially for buyers who have already nabbed properties in one of the seven German metropoles, the so-called commuter belt or in trend cities like Leipzig or Dresden.

Indeed, Postbank's "Wohnatlas" predicts price rices of more than two percent per year (adjusted for inflation) until 2035 in many of these areas, with others seeing consistent price rises of between one and two percent.

However, there could be some who see the value of their property decline in the long term. This will primarily affect regions with an aging population such as Saarland, Saxony, Saxony-Anhalt and Thuringia, as well as parts of the Rührgebiet like Gelsenkirchen, Hagen, Duisburg and Bochum.

Nevertheless, buyers who aren't looking for an investment but simply want somewhere to live or some security in their old age could still find good deals in these regions, according to Postbank.

Advice for buyers and sellers

It's hard to know what will happen to the property market too long into the future, but in many regions experts do believe that prices will drop slightly, while interest rates could stabilise in the second half of the year.

This could make it sensible to wait a little before trying to find your dream property, though getting expert advice that's specific to your region and requirements is always a sensible move.

According to real estate firm Heinrichs Immobilien, sellers should plan more time for the sale of their property in the coming years. Rather than expecting it all to be done and dusted with in 3-4 months, these days a sale period of 6-9 months is much more realistic.

The firm also say that sellers should ensure they get an accurate valuation for their property and plan a sensible marketing strategy with their estate agent - as well as leaving plenty of time to find the perfect buyer.

READ ALSO: The rules foreigners need to know when buying property in Germany

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.