With rising interest rates and a potential recession on the cards, the prospects for Germany's housing market have been looking increasingly gloomy of late. Back in September, a study by the Hamburg-based Gewos Institute for Urban, Regional and Housing research revealed that interest in property purchases has slumped, with sales of flats and houses in Germany set to drop by seven percent in 2022.

Based on the data for the first half of the year, real estate companies are expected to see their revenues decline for the first time since 2009, Gewos revealed. In places like Munich and Frankfurt - some of the most expensive German cities where property prices have been rising for years - analysts from Swiss bank UBS predict that the housing bubble could be about to burst.

READ ALSO: Why Germany’s property boom could be coming to an end

Advertisement

Outside of the major metropoles, however, investors have long been eyeing up smaller cities and towns where property prices remain low. Now, a new analysis of property prices in Germany's university towns suggests that student hotspots could be particularly attractive, despite the volatile housing market.

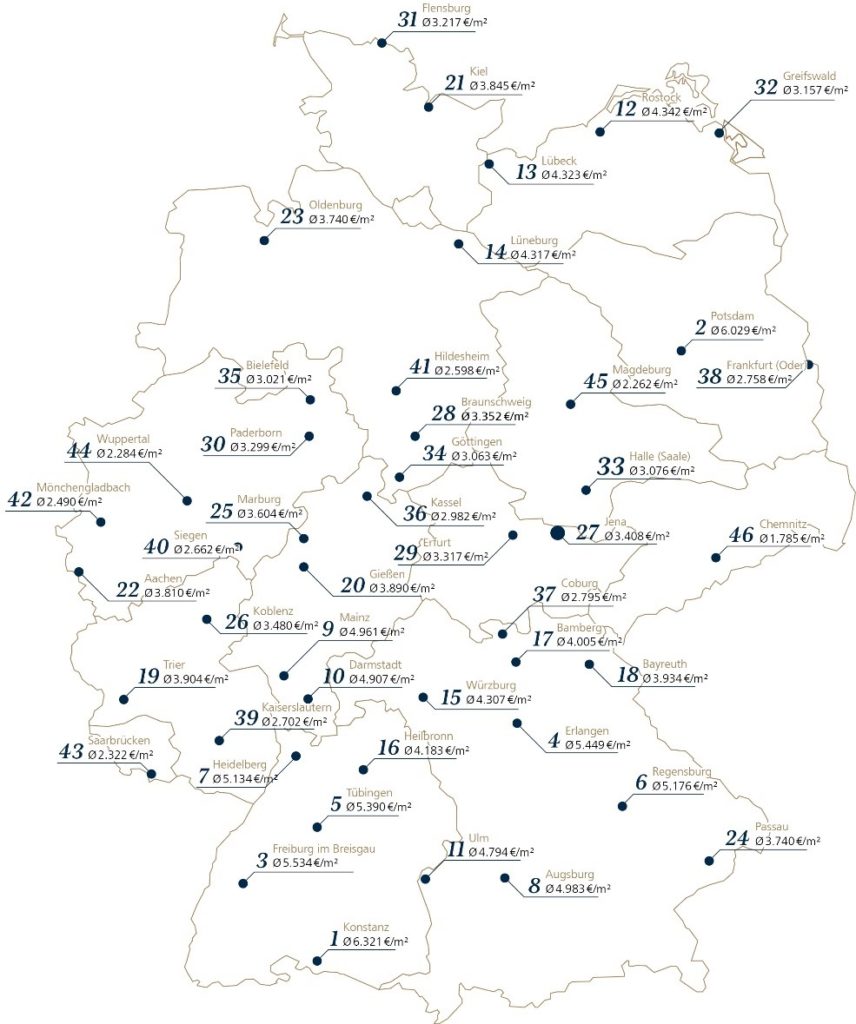

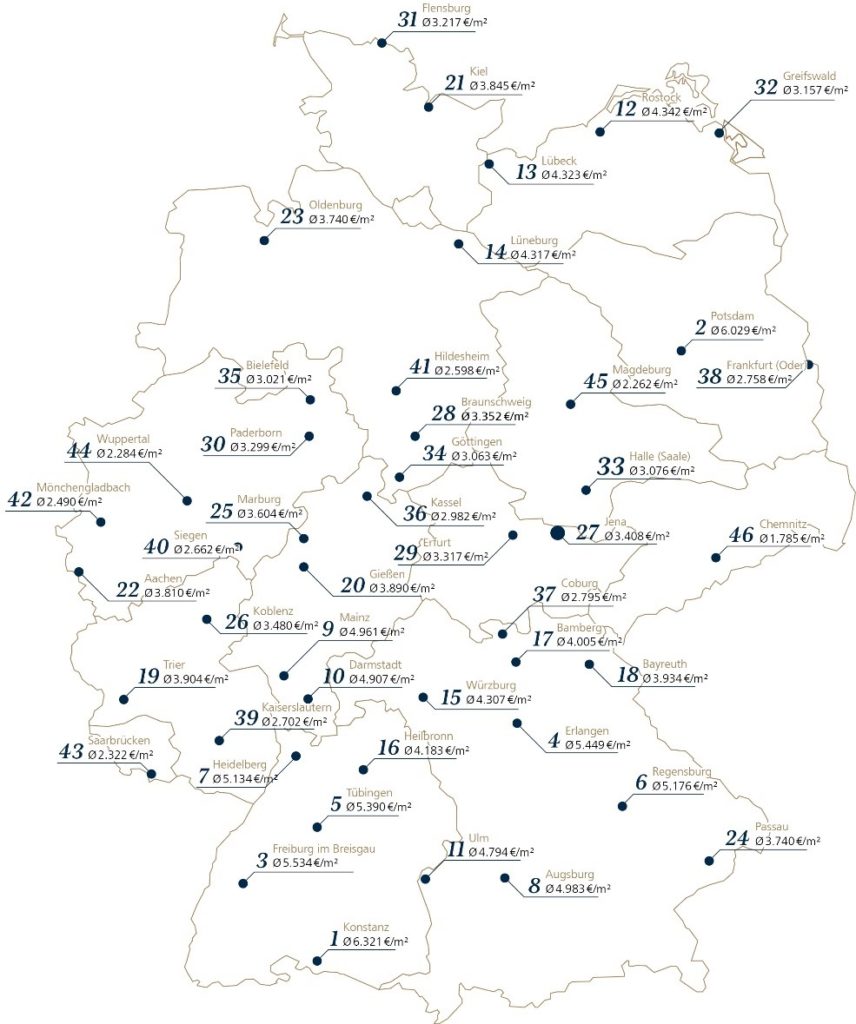

For the survey, estate agent Von Poll Immobilien looked at price trends in a total of 46 university towns across Germany from the the first quarter to the third quarter of 2022, excluding so-called 'A' and 'B' cities like Berlin, Düsseldorf and Cologne. To be classed as a university town, at least 7,000 students had to be resident there.

In 35 of the towns, house prices have either fallen or stagnated throughout the year. Saarland's capital Saarbrücken showed the most extreme drop in property prices over the period, with the cost of property per square metre sinking by 11.9 percent. In Q3, the average cost of buying a flat in Saarbrücken was €2,322 per square metre.

Behind Saarbrücken, the university towns of Lüneberg and Erfurt showed the most dramatic fall in house prices, with a dropoff of 11.8 percent and 9.4 percent respectively. In both Göttingen and Ulm, house prices fell by 8.2 percent, while Bayreuth and Oldenburg sank by eight percent over the same period.

"The real estate market has been visibly on the move in many places since the spring. This also applies to the smaller university towns," explained Daniel Ritter, managing partner at von Poll Immobilien. "Real estate prices are stagnating or falling in certain regions and segments - although very good and high-demand micro-locations will be less affected."

READ ALSO: EXPLAINED: What you need to know about buying property in Germany

Bucking the trend

Though prices remained stable or fell in around three quarters of the university towns surveyed, 11 of the student hotspots exhibited high growth despite the challenging market.

The biggest jump in property prices was in the town of Erlangen, a Bavarian town just north of Nuremberg, where the price per square metre rose by 8.3 percent to €5,449. This was largely spurred on by the presence of big companies like Siemens, Adidas and Puma in the region, which has been driving interest from foreign investors.

Prices also went up significantly in the idyllic town of Coburg, another Franconian town located just 90km to the north of Erlangen. Here, property prices shot up by 6.3 percent to €2,795 per square metre.

In other regions, the spike was less dramatic, though seven of the university towns saw modest price rises over the period. Bamberg, Kaiserslautern, Konstanz, Aachen, Flensburg, Frankfurt (Oder) und Magdeburg all saw house prices go up between 1.5 and 3 percent between Q1 and Q3.

Numerous ships docked in the harbour of Constance , a university town in the south of Germany. Photo: picture alliance/dpa | Felix Kästle

"The announcement that the American semiconductor manufacturer Intel was settling in Magdeburg had a noticeable impact on the property market. Since then we have seen a surge in property enquiries. However, there were fewer property offers and stable prices at that time," said Heike Hoffmann, an estate agent at Von Poll Immobilien Magdeburg. "Against the backdrop of higher mortgage rates and the current inflation trend, however, we are noticing a reluctance to buy."

"Nevertheless, many sellers are sticking to their high asking prices, which means that the number of property offers on the Magdeburg market has almost doubled compared to the same period last year."

READ ALSO: How the housing bubble in Frankfurt and Munich could be set to burst

Advertisement

The cheapest and most expensive university towns

There were also significant differences in the asking prices for property across the university towns surveyed.

The property price analysis of the smaller university towns for the third quarter of 2022 suggests that prospective buyers can expect the highest prices for a flat in Constance at €6,321/m2 and Potsdam at €6,029/m2. But while prices per square metre in Constance have risen slightly by two percent compared to the first quarter of 2022, they dropped by as much as 7.8 percent in Potsdam, the capital of Brandenburg.

"Recently, we recorded significant price increases in Potsdam and property sellers were able to hold on to the sometimes very high asking prices - this is now changing," said Andreas Güthling, branch manager of Von Poll Immobilien Potsdam and Werder. "Due to the increased financing interest rate, many prospective buyers now have to recalculate their search budget."

Properties in the pricier university towns otherwise ranged between €5,000 and €6,000 per square metre - a similar price to flats in Berlin and Stuttgart. The majority of these were located in the southern states of Baden-Württemberg and Bavaria, with Freiburg im Breisgau topping the charts at €5,534/m2.

Property prices in the smaller university towns in Q3/2022. Source: Von Poll Immobilien

The fourth most expensive town - where prices are also rising most steeply - was Erlangen, where property currently costs €5,449/m2, followed by Tübingen at €5,390/m2, Regensburg at €5,176/m2 and Heidelberg at €5,134/m2.

However, not all of the towns came with an eye-watering price tag for property. At just €1,785 per square metre, property in the town of Chemnitz in Saxony was by far the most affordable location for buyers - though prices of between €2,000 and €3,000 per square metre were far from unusual in the survey.

Advertisement

With the exception of Frankfurt (Oder) - which is located in Brandenburg on the Polish border - the most moderate prices were found in central and western German university towns, including Magdeburg, Wuppertal, Saarbrücken, Mönchengladbach, Hildesheim, Siegen, Kaiserslautern, Coburg und Kassel.

Where are the best investment opportunities?

According to Von Poll Immobilien, a major factor in deciding the potential for good returns on a buy-to-let is the so-called Purchase Price Factor, or Kaufpreisfaktor. This essentially calculates how long a property would need to be rented out in order to earn back the purchase price.

A property with a factor of 20 would have to be rented out for 20 years, while another with a factor of 40 would have to be rented out for 40 years, and so on.

For several years, a multiplier of 20 was considered a benchmark for a very profitable investment. With steep rises in property prices, however, this benchmark has shifted.

"In most German regions, purchase price factors of around 25 can now be found, but multipliers of 30 are no longer uncommon," the researchers at Von Poll Immobilien explained. "In metropolises and large cities in particular, purchase price factors often exceed this threshold many times over."

The entrance to Potsdam university. Photo: picture alliance/dpa | Christophe Gateau

In almost half (22) of the university towns, the Purchase Price Factor was more than 30, while properties in the remaining 24 towns had a factor of between 20 and 30.

In the third quarter of 2022, Potsdam had the highest Purchase Price Factor of 39.5, followed by Halle and Erlangen, with factors of 35.6 and 35.4 respectively,

On the lowest end of the scale was Saarbrücken, with a factor of just 21.8, followed by Göttingen (23.4), Mönchengladbach (24.3), Wuppertal (24.5) and Kaiserslautern (24.6). A full list of the purchase prices factors (in German) can be found here.

"Cities with attractive courses of study continue to have especially high potential for value appreciation," said Ritter. "However, investors should carefully examine the return potential of the locations and the targeted property as well as their individual criteria and market development and also consult professional real estate experts."

READ ALSO: The hidden costs of buying a house in Germany

Advertisement

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.