Reader question: Do I have to pay Germany's Rundfunkbeitrag?

Germany's monthly TV licence fee of €18.36 can be a burdensome expense, especially in the current climate. But there are some circumstances in which you don’t have to pay.

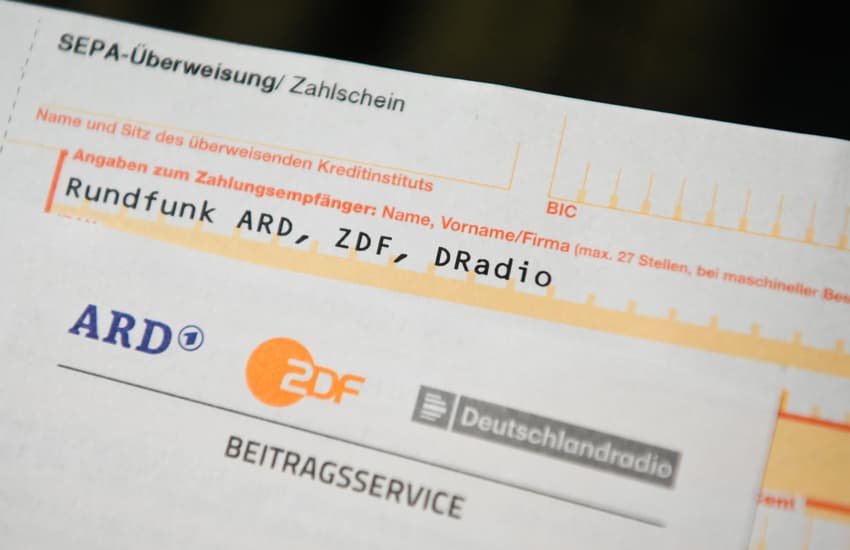

Many people who first move to Germany and see the letter from the German broadcasting service assume it doesn’t apply to them if they don’t have a TV or radio in their home.

However, in Germany, every household is obliged to pay broadcasting fees, regardless of whether there is a radio, television, or computer in the home or not.

The fee amounts to €18.36 per month and can be paid by direct debit or by quarterly invoice. But watch out if you pay by quarterly invoice: recent changes mean that you will only receive one letter per year reminding you when the payments are to be made (February 15th, May 15th, August 15th, and November 15th) and late payments are met with an initial €8 fine.

READ ALSO: People in Germany face higher TV tax payments

The number of people living in the household is also irrelevant and a flat fee is charged per home, meaning those who live alone can be hit particularly hard by the monthly bill.

However, if you're running a business, the monthly charge depends on how many employees are working in a particular office, starting at €6,12 per month for 0-8 employees. The full scale can be found in this document.

The fee is justified on the basis that the government wants to provide “a diversity of high-quality programmes on television, on the radio, online and in media libraries” without having to rely on commercial networks and advertising.

But what if I can’t afford to pay?

With high inflation and the cost of living on the rise in Germany at the moment, it’s understandable that many people will be wondering if they can avoid having to pay over €200 a year for a service they may not use.

The good news is that there are certain cases where you can be exempted from the obligation or be entitled to a reduction.

READ ALSO: EXPLAINED: How to pay Germany’s TV tax, or (legally) avoid it

Recipients of government welfare benefits – including unemployment benefits, disability benefits or old age pensions – are exempted from the payment.

For married couples and registered partnerships, the following applies: if one of the partners is exempt from the broadcasting fee, the other does not have to pay either.

Those who are vision or hearing impaired can apply to the Beitraggservice to have the fee reduced or removed completely.

In most cases, students and people completing apprenticeships (Ausbildung or Lehrzeit) will not have to pay, provided they receive student support funding from the state (known as the BAföG).

If a resident in a shared apartment is exempt from the fee because he or she receives BAfög, however, another non-exempt roommate will have to pay the broadcasting fee.

If you are entitled to an exemption from the obligation to pay the broadcasting fee or a reduction of the broadcasting fee, you can fill out this form on the website of the contribution service.

However, if none of these categories applies to you, don’t simply not pay because you can’t afford it. This will just lead to a piling up of debt and in the absolute worst case, could even result in jail time.

Useful vocabulary:

Broadcasting service = (das) Rundfunk

Contribution = (der) Beitrag

Fee = (die) Gebühr

Warning = (die) Mahnung

We’re aiming to help our readers improve their German by translating vocabulary from some of our news stories. Did you find this article useful? Let us know.

Comments (2)

See Also

Many people who first move to Germany and see the letter from the German broadcasting service assume it doesn’t apply to them if they don’t have a TV or radio in their home.

However, in Germany, every household is obliged to pay broadcasting fees, regardless of whether there is a radio, television, or computer in the home or not.

The fee amounts to €18.36 per month and can be paid by direct debit or by quarterly invoice. But watch out if you pay by quarterly invoice: recent changes mean that you will only receive one letter per year reminding you when the payments are to be made (February 15th, May 15th, August 15th, and November 15th) and late payments are met with an initial €8 fine.

READ ALSO: People in Germany face higher TV tax payments

The number of people living in the household is also irrelevant and a flat fee is charged per home, meaning those who live alone can be hit particularly hard by the monthly bill.

However, if you're running a business, the monthly charge depends on how many employees are working in a particular office, starting at €6,12 per month for 0-8 employees. The full scale can be found in this document.

The fee is justified on the basis that the government wants to provide “a diversity of high-quality programmes on television, on the radio, online and in media libraries” without having to rely on commercial networks and advertising.

But what if I can’t afford to pay?

With high inflation and the cost of living on the rise in Germany at the moment, it’s understandable that many people will be wondering if they can avoid having to pay over €200 a year for a service they may not use.

The good news is that there are certain cases where you can be exempted from the obligation or be entitled to a reduction.

READ ALSO: EXPLAINED: How to pay Germany’s TV tax, or (legally) avoid it

Recipients of government welfare benefits – including unemployment benefits, disability benefits or old age pensions – are exempted from the payment.

For married couples and registered partnerships, the following applies: if one of the partners is exempt from the broadcasting fee, the other does not have to pay either.

Those who are vision or hearing impaired can apply to the Beitraggservice to have the fee reduced or removed completely.

In most cases, students and people completing apprenticeships (Ausbildung or Lehrzeit) will not have to pay, provided they receive student support funding from the state (known as the BAföG).

If a resident in a shared apartment is exempt from the fee because he or she receives BAfög, however, another non-exempt roommate will have to pay the broadcasting fee.

If you are entitled to an exemption from the obligation to pay the broadcasting fee or a reduction of the broadcasting fee, you can fill out this form on the website of the contribution service.

However, if none of these categories applies to you, don’t simply not pay because you can’t afford it. This will just lead to a piling up of debt and in the absolute worst case, could even result in jail time.

Useful vocabulary:

Broadcasting service = (das) Rundfunk

Contribution = (der) Beitrag

Fee = (die) Gebühr

Warning = (die) Mahnung

We’re aiming to help our readers improve their German by translating vocabulary from some of our news stories. Did you find this article useful? Let us know.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.