Will Germany reduce VAT to ease the cost of living crisis?

With inflation reaching its highest level since 1981, German politicians are considering other measures for easing the financial strain on consumers. Could a reduction in VAT be on the horizon?

What's the background?

Increasing energy prices have been driving up the cost of living in Germany for months, and the Ukraine war has exacerbated the situation.

Massively rising energy costs are not only hitting consumers hard at the petrol pumps, but also in the supermarkets.

Over the last few weeks, a number of Germany's biggest supermarket chains, including Aldi, Edeka and Rewe, have increased the prices of hundreds of products.

According to Focus Online, prices for butter, coffee, and meat have risen sharply in the last few days, with the lowest price for 250 grams of "German-brand butter" now €2.09.

A breakfast of coffee with bread, butter and marmalade. Photo: picture alliance / dpa-tmn | ASA Selection

According to a recent YouGov survey commissioned by Postbank, around one in seven adults in Germany (15.2 percent) say they can now barely meet their living costs.

What is the outlook?

At the end of March, the Federal Statistical Office (Destatis) announced an inflation rate of 7.3 percent - the highest since 1981 and a jump of 2.5 percent from February.

READ ALSO: German inflation hits post-reunification high at 7.3 percent

According to Deloitte's chief economist, Alexander Börsch, who recently spoke to Focus Online, whether inflation remains as high as it is or even heats up further will largely depend on how the Ukraine war develops.

"If these energy supplies break off, whether due to a halt by Russia or an embargo by Europe, there is a threat of a supply shock", he said.

This means that if there is limited energy supply, the direct or indirect effect will be rising prices and, in the worst case, there is a threat of more inflation increases.

What countermeasures are being proposed?

At the end of March, the coalition government announced a relief package amounting to several billion euros to alleviate some of the financial pressure on consumers.

The measures included a €300 lump sum for income taxpayers and €200 for benefits recipients to support them with their energy bills, €9 monthly travel tickets and tax reductions on petrol and diesel.

READ ALSO: Cheap transport and tax cuts: What Germany’s energy relief package means for you

One proposal – which the AfD has put forward – is to suspend value-added tax (VAT) on food and fuel. Parliamentarian René Springer told DPA: "We now need significant tax cuts on food and fuel to avert existential hardship for millions of citizens."

How likely is it that VAT could be reduced?

According to experts from the Bundestag's Research Office, a short-term suspension of the value-added tax on gasoline, diesel, heating oil, gas, electricity, or basic foodstuffs in order to cushion the extreme price increases would not be possible under European law.

In an analysis of the legal situation, the experts refer to the so-called EU VAT Directive in which the member states set common guidelines for value-added tax to ensure uniform conditions of competition.

The inscription "for you 16%" as well as the crossed-out inscription "19%" indicate the reduced VAT rate of 16 percent on a shop window in November 2020. Photo: picture alliance/dpa | Hauke-Christian Dittrich

According to the directive, the regular tax rate must be at least 15 percent, and the reduced rate must be at least 5 percent. Accordingly, total tax exemptions are only possible in certain areas that serve the common good, such as hospital and medical treatment or education. Food, fuel, and heating are not included in this category.

READ ALSO: German consumers to be hit by further price hikes in supermarkets

"This rules out a full VAT exemption for these services," says the expert report, which was requested by AfD member of parliament René Springer. The national legislator is bound to the EU requirements due of the fact that VAT is harmonised and member states cannot create their own exemptions. The experts also see no "basis in EU law" for introducing a reduced tax rate for fuel and heating costs.

Although it seems that a complete halt of VAT is very unlikely, it could be that the VAT level is dropped to the European minimum.

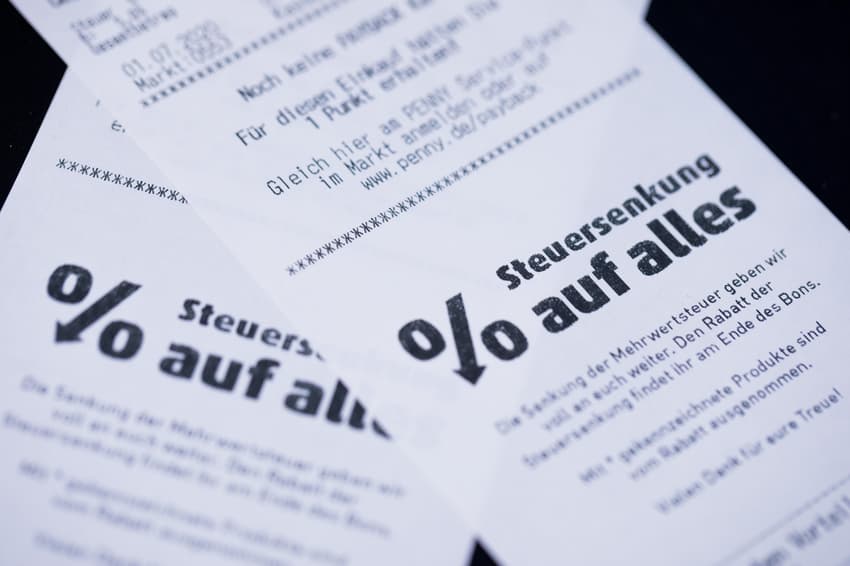

In 2020, the German government reduced the regular tax rate of VAT from 19 percent to 16 percent and the reduced tax rate from seven to five percent to alleviate financial pressure caused by the Covid pandemic.

Did you know?

When calculating the consumer price index or the inflation rate, the Federal Statistical Office (Destatis) uses an imaginary shopping basket of 650 goods and services purchased by private households in Germany.

This basket of goods is constantly updated and adjusted to demand, and the reporting of price increases or decreases depends on how the prices for these goods change from month to month.

Every month, the Federal Statistical Office publishes detailed figures on the price development of certain goods, resulting in the so-called consumer price index. The change in the consumer price index compared with the same month of the previous year or the previous year is known as the inflation rate.

Comments

See Also

What's the background?

Increasing energy prices have been driving up the cost of living in Germany for months, and the Ukraine war has exacerbated the situation.

Massively rising energy costs are not only hitting consumers hard at the petrol pumps, but also in the supermarkets.

Over the last few weeks, a number of Germany's biggest supermarket chains, including Aldi, Edeka and Rewe, have increased the prices of hundreds of products.

According to Focus Online, prices for butter, coffee, and meat have risen sharply in the last few days, with the lowest price for 250 grams of "German-brand butter" now €2.09.

According to a recent YouGov survey commissioned by Postbank, around one in seven adults in Germany (15.2 percent) say they can now barely meet their living costs.

What is the outlook?

At the end of March, the Federal Statistical Office (Destatis) announced an inflation rate of 7.3 percent - the highest since 1981 and a jump of 2.5 percent from February.

READ ALSO: German inflation hits post-reunification high at 7.3 percent

According to Deloitte's chief economist, Alexander Börsch, who recently spoke to Focus Online, whether inflation remains as high as it is or even heats up further will largely depend on how the Ukraine war develops.

"If these energy supplies break off, whether due to a halt by Russia or an embargo by Europe, there is a threat of a supply shock", he said.

This means that if there is limited energy supply, the direct or indirect effect will be rising prices and, in the worst case, there is a threat of more inflation increases.

What countermeasures are being proposed?

At the end of March, the coalition government announced a relief package amounting to several billion euros to alleviate some of the financial pressure on consumers.

The measures included a €300 lump sum for income taxpayers and €200 for benefits recipients to support them with their energy bills, €9 monthly travel tickets and tax reductions on petrol and diesel.

READ ALSO: Cheap transport and tax cuts: What Germany’s energy relief package means for you

One proposal – which the AfD has put forward – is to suspend value-added tax (VAT) on food and fuel. Parliamentarian René Springer told DPA: "We now need significant tax cuts on food and fuel to avert existential hardship for millions of citizens."

How likely is it that VAT could be reduced?

According to experts from the Bundestag's Research Office, a short-term suspension of the value-added tax on gasoline, diesel, heating oil, gas, electricity, or basic foodstuffs in order to cushion the extreme price increases would not be possible under European law.

In an analysis of the legal situation, the experts refer to the so-called EU VAT Directive in which the member states set common guidelines for value-added tax to ensure uniform conditions of competition.

According to the directive, the regular tax rate must be at least 15 percent, and the reduced rate must be at least 5 percent. Accordingly, total tax exemptions are only possible in certain areas that serve the common good, such as hospital and medical treatment or education. Food, fuel, and heating are not included in this category.

READ ALSO: German consumers to be hit by further price hikes in supermarkets

"This rules out a full VAT exemption for these services," says the expert report, which was requested by AfD member of parliament René Springer. The national legislator is bound to the EU requirements due of the fact that VAT is harmonised and member states cannot create their own exemptions. The experts also see no "basis in EU law" for introducing a reduced tax rate for fuel and heating costs.

Although it seems that a complete halt of VAT is very unlikely, it could be that the VAT level is dropped to the European minimum.

In 2020, the German government reduced the regular tax rate of VAT from 19 percent to 16 percent and the reduced tax rate from seven to five percent to alleviate financial pressure caused by the Covid pandemic.

Did you know?

When calculating the consumer price index or the inflation rate, the Federal Statistical Office (Destatis) uses an imaginary shopping basket of 650 goods and services purchased by private households in Germany.

This basket of goods is constantly updated and adjusted to demand, and the reporting of price increases or decreases depends on how the prices for these goods change from month to month.

Every month, the Federal Statistical Office publishes detailed figures on the price development of certain goods, resulting in the so-called consumer price index. The change in the consumer price index compared with the same month of the previous year or the previous year is known as the inflation rate.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.