Why rent prices in major German cities are starting to fall

After a long period of soaring rents in Germany, rental costs have started to taper off - and even decline - in major cities across the country. Experts believe that tenants in the priciest cities have reached their financial breaking point.

Looking to move? Find your next rental apartment here.

A recent study by housing search portal Immowelt found that rents have remained stable in some of the largest and most expensive cities in the country as new tenants struggle to afford what's on the market.

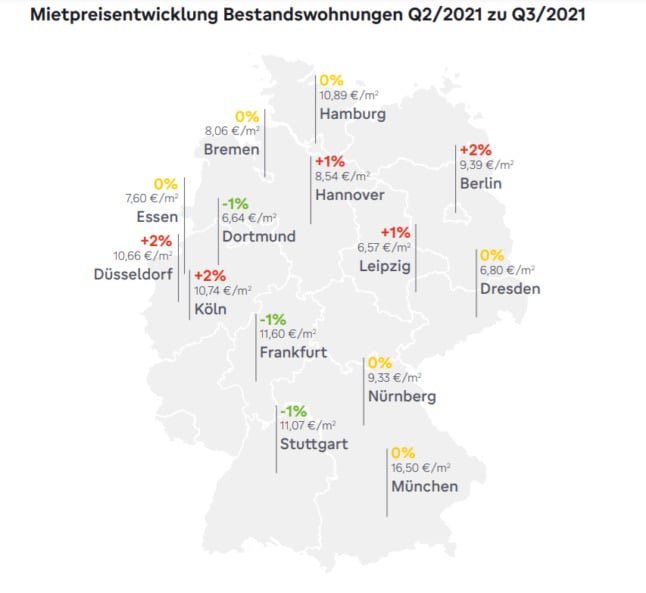

In Munich, Hamburg, Frankfurt and Stuttgart - which often top the charts as some of the priciest places to live in Germany - rents have stagnated over summer and autumn, lifting hopes that the period of ever-rising rents could be gradually coming to an end.

At present, average asking prices for an existing flat (rather than a new build) stand at €16.50 per square metre in Munich and €10.98 per square metre in Hamburg - though the prices for new builds tend to be higher.

In Frankfurt - Germany's second most expensive city - tenants have even enjoyed a slight decline in rent prices over the same period.

While in the second quarter of 2021, Frankfurt residents would have been expected to pay asking rents of €11.72 per square metre for a rental property, by the third quarter, this had sunk by one percent to €11.60 per square metre.

In Stuttgart, the third most expensive city, rents have also dropped by one percent to €11.07 per square metre.

READ ALSO:

- EXPLAINED: Where rents are falling (and going up) in Germany’s biggest cities

- COMPARE: The cities in Germany with the fastest-rising rents

'Price curves flattening out'

For its quarterly Mietkompass survey, Immowelt looked at the prices of exisiting properties listed on its portal to determine average prices for new tenants. Each of the properties were three-bedroom, 80-square-metre, second-floor flats.

Out of 14 major cities surveyed, only five of them saw rent prices go up between the second and third quarter of the year, compared to eight cities in study conducted earlier this year.

In six of the cities, the rents stagnated, while in three of them, they went down.

Map showing the development in rental costs between the second and third quarter of 2021 in Germany. Source: Immowelt

"This means that the price curves are flattening out in more and more cities," the authors of the study explained.

There was, however, one notable exception to the rule: in Berlin, where rents have been rising at a dizzying pace, new tenants had to shoulder yet another increase.

READ ALSO: Berlin’s super election day: What does it mean for the city’s housing shortage?

While at the start of the year, average asking rents stood at €9.06 per square metre, new tenants currently have to pay an average of €9.36 per square metres for a flat. Between the second and third quarter alone, asking rents snuck up by two percent, Immowelt found.

According to the researchers, this can partly put down to a rebound effect after the city's rental cap was ruled unconstitutional in April.

However, even before the rent cap was thrown out by the courts, Germany's capital remained the city with the fastest rising rents in the country.

On September 26th, Berliners voted 'yes' in a referendum calling for the properties of major landlords to be brought into state hands. However, it is still unclear whether the advisory referendum will be enforced by politicians and whether it will overcome any legal challenges it may face.

In addition to Berlin, rents also went up slightly in Cologne, Hannover, Düsseldorf and Leipzig.

Dresden, Nuremberg, Bremen and Essen all remained the same.

Rents no longer affordable for many

In the view of Jan-Carl Mehles, Immowelt's Group Leader for Market Research and PR, stagnating rents in the most expensive cities can be seen as a sign that tenants are already financially overstretched.

"More and more major cities now have stable asking rents," he said. "After some drastic increases, we're now observing some subtle price corrections.

"In addition to market relief, for example through subsidised new developments, simple market mechanisms are also dampening price growth - the limits of affordability have been reached in some places."

Protesters from the 'Mietenstopp' campaign gather with a banner calling for a national rent cap in Germany. Photo: picture alliance/dpa | Jonas Walzberg

According to the authors of the study, with a large proportion of people struggling to afford rents in major cities, making further price hikes unsustainable.

"One reason for the unchanged prices could be that even higher rents can no longer be enforced on the market," they wrote. "Many tenants are already having major problems affording an apartment in these cities."

This means that most renters in Germany can look forward to a period of relative calm after several years of rent hikes.

In Berlin, however, where the market is still catching up to where it was before the rent cap, tenants look set for at least another six months of increases, Immowelt claims.

"Before the introduction of the rent cap, rents for existing apartments were on the verge of breaking the €10 barrier," said Mehles. "Despite a recent uptick in rents, the current price level is still some way off this.

"However, we assume that there will be further price increases and that by the beginning of next year rents will already be above the level they were before the rent cap."

Comments

See Also

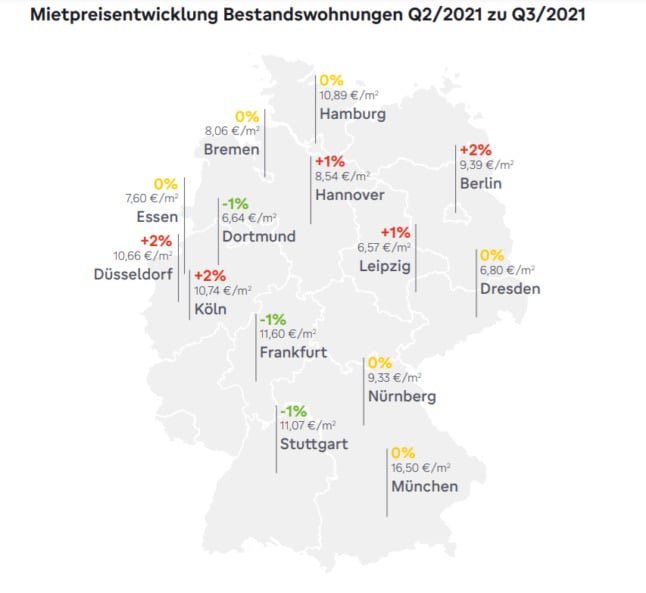

A recent study by housing search portal Immowelt found that rents have remained stable in some of the largest and most expensive cities in the country as new tenants struggle to afford what's on the market.

In Munich, Hamburg, Frankfurt and Stuttgart - which often top the charts as some of the priciest places to live in Germany - rents have stagnated over summer and autumn, lifting hopes that the period of ever-rising rents could be gradually coming to an end.

At present, average asking prices for an existing flat (rather than a new build) stand at €16.50 per square metre in Munich and €10.98 per square metre in Hamburg - though the prices for new builds tend to be higher.

In Frankfurt - Germany's second most expensive city - tenants have even enjoyed a slight decline in rent prices over the same period.

While in the second quarter of 2021, Frankfurt residents would have been expected to pay asking rents of €11.72 per square metre for a rental property, by the third quarter, this had sunk by one percent to €11.60 per square metre.

In Stuttgart, the third most expensive city, rents have also dropped by one percent to €11.07 per square metre.

READ ALSO:

- EXPLAINED: Where rents are falling (and going up) in Germany’s biggest cities

- COMPARE: The cities in Germany with the fastest-rising rents

'Price curves flattening out'

For its quarterly Mietkompass survey, Immowelt looked at the prices of exisiting properties listed on its portal to determine average prices for new tenants. Each of the properties were three-bedroom, 80-square-metre, second-floor flats.

Out of 14 major cities surveyed, only five of them saw rent prices go up between the second and third quarter of the year, compared to eight cities in study conducted earlier this year.

In six of the cities, the rents stagnated, while in three of them, they went down.

Map showing the development in rental costs between the second and third quarter of 2021 in Germany. Source: Immowelt

"This means that the price curves are flattening out in more and more cities," the authors of the study explained.

There was, however, one notable exception to the rule: in Berlin, where rents have been rising at a dizzying pace, new tenants had to shoulder yet another increase.

READ ALSO: Berlin’s super election day: What does it mean for the city’s housing shortage?

While at the start of the year, average asking rents stood at €9.06 per square metre, new tenants currently have to pay an average of €9.36 per square metres for a flat. Between the second and third quarter alone, asking rents snuck up by two percent, Immowelt found.

According to the researchers, this can partly put down to a rebound effect after the city's rental cap was ruled unconstitutional in April.

However, even before the rent cap was thrown out by the courts, Germany's capital remained the city with the fastest rising rents in the country.

On September 26th, Berliners voted 'yes' in a referendum calling for the properties of major landlords to be brought into state hands. However, it is still unclear whether the advisory referendum will be enforced by politicians and whether it will overcome any legal challenges it may face.

In addition to Berlin, rents also went up slightly in Cologne, Hannover, Düsseldorf and Leipzig.

Dresden, Nuremberg, Bremen and Essen all remained the same.

Rents no longer affordable for many

In the view of Jan-Carl Mehles, Immowelt's Group Leader for Market Research and PR, stagnating rents in the most expensive cities can be seen as a sign that tenants are already financially overstretched.

"More and more major cities now have stable asking rents," he said. "After some drastic increases, we're now observing some subtle price corrections.

"In addition to market relief, for example through subsidised new developments, simple market mechanisms are also dampening price growth - the limits of affordability have been reached in some places."

Protesters from the 'Mietenstopp' campaign gather with a banner calling for a national rent cap in Germany. Photo: picture alliance/dpa | Jonas Walzberg

According to the authors of the study, with a large proportion of people struggling to afford rents in major cities, making further price hikes unsustainable.

"One reason for the unchanged prices could be that even higher rents can no longer be enforced on the market," they wrote. "Many tenants are already having major problems affording an apartment in these cities."

This means that most renters in Germany can look forward to a period of relative calm after several years of rent hikes.

In Berlin, however, where the market is still catching up to where it was before the rent cap, tenants look set for at least another six months of increases, Immowelt claims.

"Before the introduction of the rent cap, rents for existing apartments were on the verge of breaking the €10 barrier," said Mehles. "Despite a recent uptick in rents, the current price level is still some way off this.

"However, we assume that there will be further price increases and that by the beginning of next year rents will already be above the level they were before the rent cap."

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.