Germany launches first 'green' bonds to finance climate-related projects

Germany on Monday announced details

of its first "green" bond placing, tapping financial markets to fund

environmental projects for the first time.

The finance ministry said it would raise up to €11 billion in 2020 to support climate-related projects.

The first issue in September of a 10-year bond, or Bund, will have a minimum of €4 billion in volume.

The German government announced late last year that it would launch the bonds in the second half of 2020 as part of its efforts to combat climate change.

The country earmarked €54 billion in spending to 2023 as part of a climate package that includes introducing a carbon tax to cut greenhouse gases by 55 percent by 2030 compared with 1990 levels.

READ ALSO: 10 German words you need to know to engage in the climate debate

Rita Schwarzeluehr-Sutter, parliamentary state secretary for environment, said the bonds will contribute to the government's efforts.

"Green federal bonds create a clear incentive. In this way, we are showing how green and climate-friendly economic activities can be made transparent and predictable," she said.

The green bonds will be "twin bonds", issued alongside conventional federal bonds with the same maturity and coupon, the finance ministry said.

It means investors will be able to swap their bonds from one variant to the other, with the aim of making them more attractive to investors, according to Jörg Kukies, parliamentary secretary to the finance ministry.

Germany joins the green bond trend relatively late. Poland launched the world's first sovereign green bonds in 2016 and France, currently the world leading issuer of the instrument, in 2017.

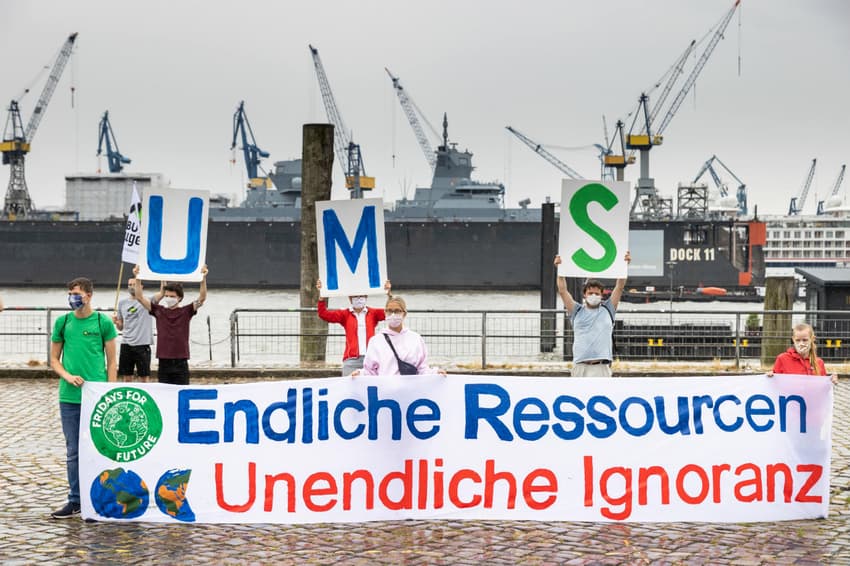

Yet environmental issues are high on the German political agenda: Greta Thunberg and representatives of the environmental activist group Fridays For Future had an audience with Chancellor Angela Merkel last week.

READ ALSO: Greta Thunberg calls on Merkel to be 'brave' in climate change fight

Green bonds accounted for 2.85 percent of global bond issuance in 2019, or around $205 billion, according to the European Central Bank.

Almost half of green bonds issued worldwide last year were in euros, the ECB added.

ECB chief Christine Lagarde said in July that climate protection was a top priority for the bank, after it unveiled a plan worth €1.35 trillion to help the European economy recover from the coronavirus pandemic.

Lagarde started at the ECB late last year with a pledge to pursue a "greener" monetary policy, raising the prospect that the bank could increase the share of climate-friendly investments in its portfolio.

Comments

See Also

The finance ministry said it would raise up to €11 billion in 2020 to support climate-related projects.

The first issue in September of a 10-year bond, or Bund, will have a minimum of €4 billion in volume.

The German government announced late last year that it would launch the bonds in the second half of 2020 as part of its efforts to combat climate change.

The country earmarked €54 billion in spending to 2023 as part of a climate package that includes introducing a carbon tax to cut greenhouse gases by 55 percent by 2030 compared with 1990 levels.

READ ALSO: 10 German words you need to know to engage in the climate debate

Rita Schwarzeluehr-Sutter, parliamentary state secretary for environment, said the bonds will contribute to the government's efforts.

"Green federal bonds create a clear incentive. In this way, we are showing how green and climate-friendly economic activities can be made transparent and predictable," she said.

The green bonds will be "twin bonds", issued alongside conventional federal bonds with the same maturity and coupon, the finance ministry said.

It means investors will be able to swap their bonds from one variant to the other, with the aim of making them more attractive to investors, according to Jörg Kukies, parliamentary secretary to the finance ministry.

Germany joins the green bond trend relatively late. Poland launched the world's first sovereign green bonds in 2016 and France, currently the world leading issuer of the instrument, in 2017.

Yet environmental issues are high on the German political agenda: Greta Thunberg and representatives of the environmental activist group Fridays For Future had an audience with Chancellor Angela Merkel last week.

READ ALSO: Greta Thunberg calls on Merkel to be 'brave' in climate change fight

Green bonds accounted for 2.85 percent of global bond issuance in 2019, or around $205 billion, according to the European Central Bank.

Almost half of green bonds issued worldwide last year were in euros, the ECB added.

ECB chief Christine Lagarde said in July that climate protection was a top priority for the bank, after it unveiled a plan worth €1.35 trillion to help the European economy recover from the coronavirus pandemic.

Lagarde started at the ECB late last year with a pledge to pursue a "greener" monetary policy, raising the prospect that the bank could increase the share of climate-friendly investments in its portfolio.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.