Guilt-stricken tax evader gives cash back

The tax office in the western German town of Siegen was delighted to receive a letter on Monday from an anonymous citizen plagued with guilt over unpaid tax from eight years ago. He or she enclosed €2,000 in cash.

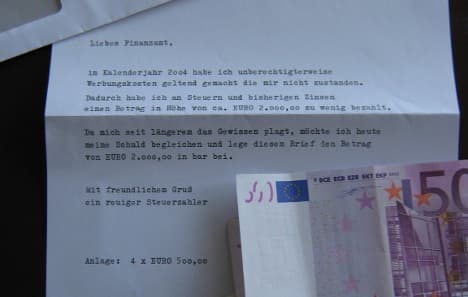

"Dear tax office," the neatly type-written letter began. "In the calendar year 2004 I unjustifiably declared advertising expenses that I was not entitled to.

"Because of that I paid a sum of €2,000 too little in taxes and interest up until now," he or she continued. "Since my conscience has been plaguing me for some time, I'd like to settle my guilt today and am enclosing the sum of €2,000 in cash in this letter."

The letter ended, "With friendly greetings, a repentant taxpayer."

It was addressed personally to the office's head official Günter Michel, who was very pleased with the "donation" of four used €500 notes, the WAZ newspaper group reported.

"It's an absolute one-off," tax office spokesman Heiko Müller told The Local. "We're just putting the money into the system for the benefit of all taxpayers as we have no idea where it's from."

The only similar occasion that Müller could recall was in 1997, when someone sent the office 20,000 Deutschmarks anonymously - though without an accompanying letter.

But Müller pointed out that though this donor might have an easier conscience, he might live to regret his actions. "It would have been cleverer to declare himself and then pay," he said. Should the tax evasion be uncovered in the future, the unknown donor will be forced to pay again.

The Local/bk

Comments

See Also

"Dear tax office," the neatly type-written letter began. "In the calendar year 2004 I unjustifiably declared advertising expenses that I was not entitled to.

"Because of that I paid a sum of €2,000 too little in taxes and interest up until now," he or she continued. "Since my conscience has been plaguing me for some time, I'd like to settle my guilt today and am enclosing the sum of €2,000 in cash in this letter."

The letter ended, "With friendly greetings, a repentant taxpayer."

It was addressed personally to the office's head official Günter Michel, who was very pleased with the "donation" of four used €500 notes, the WAZ newspaper group reported.

"It's an absolute one-off," tax office spokesman Heiko Müller told The Local. "We're just putting the money into the system for the benefit of all taxpayers as we have no idea where it's from."

The only similar occasion that Müller could recall was in 1997, when someone sent the office 20,000 Deutschmarks anonymously - though without an accompanying letter.

But Müller pointed out that though this donor might have an easier conscience, he might live to regret his actions. "It would have been cleverer to declare himself and then pay," he said. Should the tax evasion be uncovered in the future, the unknown donor will be forced to pay again.

The Local/bk

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.