Euro hits record high against the dollar

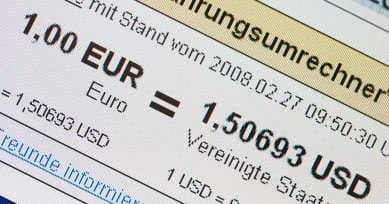

The euro has surged to a record high against the US dollar, as Europe’s single currency broke through the important psychological barrier of $1.50 late on Tuesday.

The magic barrier has been broken. Only a few weeks after the massive cuts to US interest rates, the euro has surged to new highs in the currency markets. Europe’s single currency hit a record high of $1.5047 late on Tuesday evening. But breaking through the important psychological boundary of $1.50 could be an important turning point according to economists, who believe the euro isn’t likely to soar much higher against the greenback.

Worries about the euro-zone’s economy and possible interest rate cuts by the European Central Bank are likely to weaken the euro in the coming months. Plus the euro has not appreciated against other major currencies like the Japanese yen and Swiss franc in recent months.

“The euro isn’t really such an unbelievably hard currency,“ said economist Christan Melzer from DekaBank in Frankfurt. Last year the euro appreciated against the dollar around ten percent – but measured against a basket of important world currencies the euro appreciated only seven percent over the same period. Since the start of 2008 the euro has remained largely stable against the grouped currencies, appreciating only 0.1 percent due to heavy losses on global stock markets, which made it less attractive to invest in both euros and dollars.

“The cycle is over, the dollar will recover in the second half of the year,” said Claudia Windt, an economist with the Landesbank Hesse-Thuringia. She explained that the difference in interest rates between the United States and the euro zone is likely to decrease in the last two quarters of 2008.

The US dollar has plummeted in recent months as the subprime lending crisis rocked the world’s largest economy. The US Federal Reserve cut interest rates twice in January, causing the euro to appreciate against the greenback as it became more attractive to invest in Europe than America. But the strong euro hurts big exporters like Germany, as the country’s goods become more expensive abroad.

Comments

See Also

The magic barrier has been broken. Only a few weeks after the massive cuts to US interest rates, the euro has surged to new highs in the currency markets. Europe’s single currency hit a record high of $1.5047 late on Tuesday evening. But breaking through the important psychological boundary of $1.50 could be an important turning point according to economists, who believe the euro isn’t likely to soar much higher against the greenback.

Worries about the euro-zone’s economy and possible interest rate cuts by the European Central Bank are likely to weaken the euro in the coming months. Plus the euro has not appreciated against other major currencies like the Japanese yen and Swiss franc in recent months.

“The euro isn’t really such an unbelievably hard currency,“ said economist Christan Melzer from DekaBank in Frankfurt. Last year the euro appreciated against the dollar around ten percent – but measured against a basket of important world currencies the euro appreciated only seven percent over the same period. Since the start of 2008 the euro has remained largely stable against the grouped currencies, appreciating only 0.1 percent due to heavy losses on global stock markets, which made it less attractive to invest in both euros and dollars.

“The cycle is over, the dollar will recover in the second half of the year,” said Claudia Windt, an economist with the Landesbank Hesse-Thuringia. She explained that the difference in interest rates between the United States and the euro zone is likely to decrease in the last two quarters of 2008.

The US dollar has plummeted in recent months as the subprime lending crisis rocked the world’s largest economy. The US Federal Reserve cut interest rates twice in January, causing the euro to appreciate against the greenback as it became more attractive to invest in Europe than America. But the strong euro hurts big exporters like Germany, as the country’s goods become more expensive abroad.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.